Greener Steel: Through Chemistry

In a lab outside Boulder Colorado, engineers are reinventing one of the dirtiest industrial processes on Earth—by swapping fire for modern alchemy.

By Stephen Robert Miller in Anthropocene magazine

In a business park in the shadow of the Rocky Mountains, across a road from a popular swimming lake and surrounded by craft breweries, a startup called Electra is making iron for the production of steel—but you’d never know it. There is no smoke billowing from industrial chimneys. No railyards of coal waiting to be shoveled into orange infernos. The skies over Boulder, Colorado are not impenetrably ashen; they are bluebird.

That’s because instead of coal and fire, Electra uses chemical solvents and electricity to extract high-grade iron from low-quality ore. It’s the latest—and a massive—step for a dirty industry that’s transitioning into a cleaner future.

For every ton of steel produced globally, roughly 1.85 tons of planet-heating carbon dioxide are emitted into the atmosphere. This makes the steel industry responsible for 8 percent of the world’s total CO2 emissions, which is more than all of India. Each year, worldwide manufacturers produce about 2 billion tons of steel, and as populations rise and economies boom, demand is projected to increase more than 30 percent by 2050.

Steel is an essential ingredient in everything from buildings to cars, bridges to cans. If the planet is going to draw down its carbon emissions to avoid worsening the already unavoidable impacts of climate change, it will need to clean up the industry that produces steel. And to do that, it will have to find greener ways of producing iron, steel’s raw material, which accounts for about 80 percent of steel’s total emissions.

The good news is that steelmakers and companies that depend on steel production are investing in ideas that could lead to a low-emission future. “They may just not be speaking vociferously about it because of the current administration,” says Adina Renee Radler, executive director of the Global Steel Climate Council.

But rising energy costs and global trade uncertainty are powerful motivators for change. And Electra aims to be in the right place at the right time by proving that it is possible to make iron without the need for continuous power.

Instead of coal and fire, Electra uses chemical solvents and electricity to extract high-grade iron from low-quality ore.

In a previous job, James Rutland, Electra’s chief financial officer, worked with iron and steel producers in the United Kingdom. He remembers visiting blast furnaces and thinking, “These are just scary, horrible places,” he says. “It’s like a horrible thing that you need to whack with a hammer.”

There are basically two ways to turn iron ore into iron for steelmaking: the traditional blast furnace and the use of chemical gasses.

In the traditional blast furnace method, the ore is melted using a carbon-rich fuel made from purified coal, called coke. Burning at around 3,000 degrees F, the coke melts the ore and strips away its oxides. The pig iron left behind is most often then made into steel in another blast furnace. This is the dirtiest method, producing 2.2 tons of CO2 per ton of steel. Blast furnaces are common in Europe and Asia, but they account for only 30 percent of American steel.

Direct reduction is a cleaner method in which ore is broken down into iron under lower temperatures using hydrogen or natural gas. The resulting sponge iron is then loaded into an electric arc furnace that turns iron into steel with heat from electricity instead of coal. With direct reduced iron (DRI) and an electric furnace, emissions drop to 1.4 tons of CO2 per ton of steel.

Most steel in the US isn’t derived from freshly made iron, however; it comes from processing scrap metal in an electric furnace. At 0.3 tons of C02 for every ton of steel, this is so far the cleanest available method. The challenge is finding enough scrap to satisfy the world’s growing appetite. Metal recycling rates are low, and much of the available scrap is poor quality.

Electra aims to open another avenue to low-carbon steel by making high-grade iron from some of the lowest grade ore and the dregs of the remaining scrap.

In Electra’s Boulder facility, engineers in white coats shuffle around a clean and quiet laboratory. Instead of smoldering furnaces, there are tanks filled with brown and blue liquids, connected by clear plastic tubing, all regulated by computers hooked to silver boxes with multicolored buttons and blinking lights.

The strategy is to “use as much chemistry as possible before we bring in the electrochemical portions,” explains Jesse Shapiro, a program director for Electra. “You want to minimize how much energy you’re using.” That’s because the company can run its low-temperature operation off available intermittent renewable sources, an impossible feat for blast and direct reduction furnaces that depend on high heat from an immense and consistent supply of power.

Electra’s process happens in three steps. First, chunks of rusty, oxidized iron ore are ground down to a fine ochre sand and placed into a tub with an acid solution that leaches out soluble minerals. The ore slurry is then piped through several iterations of acid baths, changing in appearance as it goes from thick cowboy coffee to weak tea.

Once the ore has been dissolved, the liquid is purified by removing minerals like silica and alumina, which can be sold to other industries for use in everything from car manufacturing to cosmetics. What remains is a refined iron liquid resembling blue Gatorade.

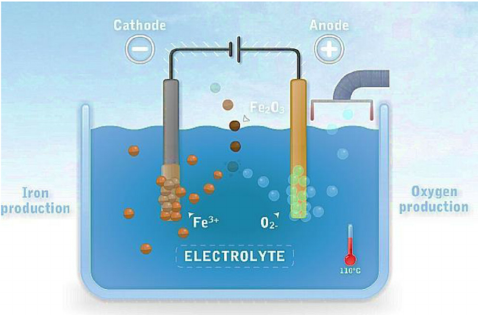

Finally, in a process called electrowinning, the purified iron solution is placed in a tub primed with an anode and a steel plate a square meter in size, the cathode. An electric current is fed into this cell through the anode, charging the dissolved iron ions in the solution and causing them to attach themselves to the steel plate. When enough pure iron has been deposited on it, the plate is pulled out and bent or scraped to free the iron, which breaks off into pieces that can vary in size from a bottlecap to much larger, depending on a steel producer’s needs.

Electrowinning is not a novel technique, but its application to ironmaking is. Other metals, like copper, zinc, and nickel, take to the process more readily. Iron is finicky, however. Its ions occur in the dissolved solution in two states—ferrous and ferric—and under a charge, it will often shuffle between them instead of turning into metal. By closely managing the solution and application of electricity to the cell, Electra has overcome this quirk.

“The exact way we do it is where that special sauce comes in,” Shapiro says.

In April, that sauce earned the company $186 million in new funding from venture capital investors, mining behemoths like Rio Tinto, and steel conglomerates including Nucor. Electra plans to build its first production facility in Colorado in 2026, with a goal toward rolling out 500 metric tons of clean iron per year. Although this pales in comparison to the 10,000 tons of iron a blast furnace produces each day, it is proof of concept.

Rather than smoldering furnaces, there are tanks filled with brown and blue liquids, connected by clear plastic tubing, all regulated by computers hooked to silver boxes with multicolored buttons and blinking lights.

While Electra plans for expansion, other companies are trying to clean up steelmaking with existing technology, and many are betting on green hydrogen. The gasses used to free iron from its ore in direct reduction today are derived from natural gas. But the steel industry has lately been in a fervor over the prospect of reducing iron with hydrogen made by splitting it from the oxygen in water, using renewable electricity.

The resulting “green hydrogen” is widely seen as the pragmatic future of low-carbon steel, but the challenge of producing the necessarily huge amounts of clean energy leaves some experts skeptical. “More realism is needed when it comes to green hydrogen: production is likely to be more limited and expensive than often forecast,” cautions the Institute for Energy Economics and Financial Analysis. The investment needed to produce enough renewable energy would dwarf the capital needed to build the ironmaking facilities.

Luckily, other ideas abound. Researchers in Germany are investigating the use of ammonia in place of hydrogen. Others would limit DRI’s emissions by reducing iron and turning it into steel in one step, powered by super-hot hydrogen plasma. Rio Tinto is looking to fuel iron reduction with biomass and microwaves. Blue Origin is exploring how to make iron with zero emissions through an electrochemical process it developed during its attempts to land on the moon. And Limelight Steel is heating furnaces with lasers.

One promising startup born out of the Massachusetts Institute of Technology, called Boston Metals, tackles the challenge with molten oxide electrolysis (MOE). Very simply put, they fill a school bus-sized battery cell with iron ore and a liquid electrolyte, then heat it to some 3,000 degrees F by running electricity between a cathode and an anode. Under such high temperatures, the iron separates from the ore, liquifies, and collects at the bottom of the cell, where it can be tapped like syrup from a maple tree.

Like Electra, Boston Metals also had to crack a technical nut in order to make steel with a process that’s been used to produce other metals for decades. In this case, it was an anode that could survive the high temperature and harsh environment inside the cell. Now, the company is building its first commercial plant in Brazil, where it will prove the technology by producing niobium, a valuable chemical element used in high-strength steel. It hopes to have its first iron-producing plant up and running by the end of the decade.

“We see the 2030s as being a transformative decade for steel,” says Adam Rauwerdink, senior vice president of business development at Boston Metals. The demand for a low-carbon alternative is there, he says—it’s just a matter of the technologies and renewable energies catching up. Boston Metals’ process needs significant and consistent energy, but Rauwerdink says it’s still an improvement over green hydrogen, because it doesn’t take the extra step of producing hydrogen only to expend it making iron.

Of course, in climate, all roads lead to the scaling hurdle. “If you’re making a tech that can do great decarbonization but can only be scaled to 5 or 10 million tons, you’re not going to move the needle in steel,” Rauwerdink says. These solutions must expand, and quickly.

More than 70 percent of the roughly 230 steel plants planned globally are slated to be coal-fired blast furnaces. China, which dominates the industry, produces a paltry 10 percent of its steel with lower-carbon electric arc furnaces. Economic sticks and carrots have encouraged some of the steel industry’s biggest customers, like automakers and heavy machinery manufacturers, to invest in cleaner technologies, but others, like the construction industry, are less willing to accept green price hikes.

To make a dent, low-carbon iron and steel will have to be economically attractive. The greenest steel today is made from recycled scrap metal in an electric furnace. With growing demand and more companies looking to clean their carbon footprint, however, “there’s going to be a very limited market for prime scrap,” Electra’s Rutland says. As a result, he sees the future in producing high-grade iron from low-grade ores, like those left in mine tailings. This hasn’t previously been an option. Blast furnaces and direct reduction demand higher grade ore or scrap, and so there are “billions and billions of tons of stranded iron ores just around mines,” he says. Once smelted into high-grade iron, steelmakers can use it outright or mix it with abundant not-so-prime scrap, like shredded cars.

To take advantage, both Electra and Boston Metals have designed their processes to be modular, so they can be built to the size needed and deployed at a seemingly exhausted mine, beside a steelmaker, or close to a large source of renewable power. Making iron closer to the supply and demand means shortening distribution networks and dispersing environmental impacts that have been so concentrated on specific communities.

It also represents a drastic makeover from the image of the hulking mill and factory that has long defined the steel industry. In the not-so-distant future, it may be possible to walk past an ironworks without ever noticing it.

___________________