In the middle of a trade war, this is one tariff the world really needs, and Australia should take the lead

Tim Buckley, Annemarie Jonson & Matt Pollard

Jun 5, 2025

In a significant development this week, newly re-elected Federal Energy Minister Chris Bowen flagged that Australia is considering imposing a carbon border adjustment mechanism (CBAM) – a carbon tariff.

He suggested that they could be introduced this term on imports such as cement, lime and steel, building on the Carbon Leakage Review the government commissioned from ANU expert Professor Frank Jotzo.

This is a good start. We hope it signals that the Albanese government intends to use the thumping mandate it just won from the electorate to scale its green superpower agenda.

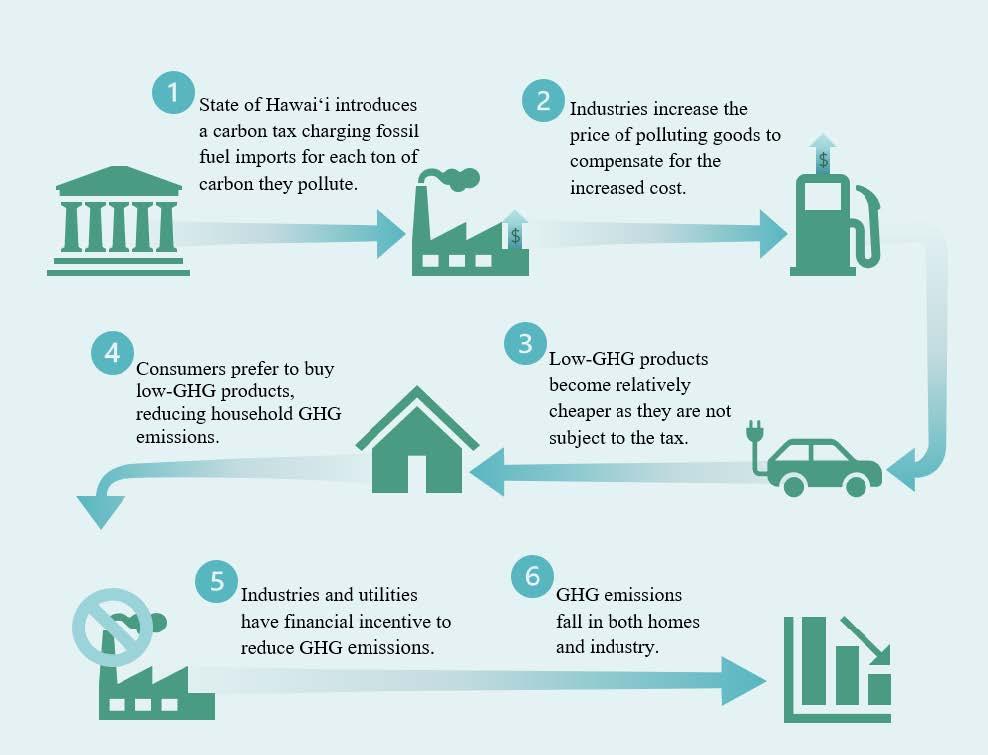

Critically, carbon tariffs internalise onto corporate balance sheets the externalised social and environmental costs of greenhouse gas emissions in international trade.

the greatest market failure the world has seen – the failure to price carbon

They correct what has been called the greatest market failure the world has seen – the failure to price carbon, the result of which is our escalating climate crisis. Ross Garnaut and Rod Sims of The Superpower Institute have long argued that the best solution is a carbon price.

The Albanese government has made good progress on the domestic front through reforms of the Safeguard Mechanism. This requires our highest emitting industrial facilities – many in mining, oil and gas, and manufacturing – to pay a penalty for emissions above a baseline, with the latter ratcheting down at 4.9% per year.

Companies are incentivised to invest in carbon mitigation and to shift to decarbonising their industrial products by processing them with zero-emissions energy – for example, green iron – boosting the value-add of our top export commodity.

Private finance can’t be mobilised at scale into these green commodity opportunities unless a carbon signal is priced-in to drive investment.

But climate change is a global problem requiring international cooperation. The greenhouse gas emissions now embedded in globally traded industrial commodities such as iron, steel, aluminium and cement make up 15% of global emissions.

As we argue in our new report (below), pricing carbon in international trade is the single most effective measure to decarbonise these industries in line with climate science via the least-cost pathway to taxpayers.

Unlike the erratically-applied, economically-destructive, investment-deterring tariffs imposed by the US, targeted CBAMs drive the greening of countries’ energy systems and industrial bases by shifting investment from fossil fuels to clean energy and green commodities. As the world economy approaches net zero, this shift underpins nations’ economic resilience, prosperity and energy security.

We believe there is a strong case for pricing carbon in regional trade in the advanced economies of Asia – led by Australia, China, Japan, South Korea and Singapore – via the development of an Asian CBAM. This would extend the European Union’s CBAM, which came into effect in 2023 and will phase in from 2026, becoming fully operational in 2034.

As the Australian government bids to host COP31 in 2026, it has a timely opportunity to lead collaboration to develop an Asian CBAM.

Our influence as a middle power – and the energy and resources trading partner of choice for much of Asia’s industrial base – makes us well placed to advocate for a regional scheme. So does our abundance of renewables and critical minerals, and our status as the world’s largest exporter of iron ore and coking coal.

The net zero transition is an immense, nation-building opportunity to pivot to value-added clean commodities such as green iron, which the Superpower Institute found could provide a more than $260bn pa economic boost compared to just shipping iron ore – greater than the annual exports of coal, oil and gas combined – repositioning us as a zero-emissions trade leader.

Our historic over-dependence on fossil fuels is facing gradual but terminal decline. Failure to act now as a key player in shaping the green industrial boom risks our future energy and national security, and economic resilience.

Australia should build on Minister Bowen’s signal to consider a carbon tariff, and accelerate efforts to advocate for a regional carbon pricing framework with key trading partners.

Our report highlights Asia-Pacific carbon pricing momentum, with 17 schemes in effect – including China’s ETS (4x the EU ETS by volume), and schemes in South Korea, Japan and Singapore.

Our report highlights Asia-Pacific carbon pricing momentum, with 17 schemes in effect – including China’s ETS (4x the EU ETS by volume), and schemes in South Korea, Japan and Singapore. It is in Asian economies’ interests to work with partners with comparative advantages in the new energy trade and low-cost renewables, such as Australia, to create a regional market in decarbonised commodities like green iron and steel, aluminium and cement. An Asian CBAM is key to this, enabling international cooperation to tackle the climate crisis, as some fossil fuel states renege on their global responsibilities.

we export with minimal value-add

Australia is a mining world leader, but we export with minimal value-add. A regional carbon price would mobilise hundreds of billions in new investment to process our commodities onshore with zero-emissions energy, ‘embedding decarbonisation’ pre-export.

An Asian CBAM aligns 100% with Australia’s national interest, a sustainable economy and a liveable planet – a win-win pathway for Asia and Australia to prosper in a rapidly decarbonising world.

Report: A price on carbon: building towards an Asian CBAM

A focus on the harmonisation and integration of carbon pricing mechanisms in Asia-Pacific for the steel, aluminium and cement value chains

5 JUN 2025

PUBLISHER

Decarbonisation Net zero Steel industry International tradeSupply chain Carbon pricing Fossil fuelsFinancial incentive mechanisms International cooperation Asia-PacificAustralia

RESOURCES

DESCRIPTION

This report calls for coordinated, targeted government intervention from key industrial economies across the Asia-Pacific to correct the persistent global market failure of unpriced emissions in the production of fossil fuel-intensive commodity processing required to achieve net zero. The report argues that this should take the form of an Asian Carbon Border Adjustment Mechanism (CBAM) and that Australia is well positioned to take a leading role in its development.

To achieve this, a set of orchestrated support measures will form the critical policy pillars required to catalyse industrial decarbonisation and electrification, including in steel, aluminium and cement supply chains. This will elevate global climate ambition and position Australia and its key trading partners to leverage the clean commodity transformation that will rapidly emerge in a decarbonised global economy.

Recommendations

- Progressively rising domestic price on carbon.

- Carbon Border Adjustment Mechanisms.

- Strategic support to scale clean commodity production.

- International collaboration, including orchestrated market incentives and an Asian CBAM.