Investment in big batteries booms as Australia’s energy transition gathers pace

‘The target is ambitious, but it’s achievable,’ expert says of Labor’s 2030 renewables goal

Petra Stock Thu 29 May 2025 in the Guardian

Investment in big batteries hit $2.4bn in the first three months of 2025, making it the second strongest quarter for energy storage on record in Australia.

The latest data from the Clean Energy Council found six new storage projects – totalling 1.5 gigawatts capacity – reached financial close (the financial commitment that means the project is likely to be built) and a level of investment last seen in the final quarter of 2023 with a record $2.8bn.

The largest was the four-hour Wooreen battery system in Victoria, at 350MW, which was supported by the federal government’s capacity investment scheme.

Three large-scale battery systems in South Australia, one in Queensland and one in New South Wales also reached financial close.

Renewable energy had a slower start to the year, with two solar farms – totalling 386MW and $410m investment – reaching financial close. A quieter first quarter was typical, the CEC said, with investment ramping up throughout the year.

“Over the past five years, new investment commitments in the first quarter of the year have averaged 427MW, compared to a Q4 average of 1,153MW over the same period,” it said.

By the end of March, 82 renewable energy projects had either reached financial commitment or were under construction, representing 12GW of capacity.

The strong result for storage in the first quarter followed Australia’s biggest yearfor clean energy investment in 2024, in which rooftop solar installations on homes and businesses raced past 4m, the CEC’s annual snapshot found.

Investment in large-scale renewable energy hit $9bn, a 500% increase on 2023. This combined with investment in energy storage to deliver the nation’s highest clean energy investment on record at $12.7bn.

The CEC’s chief policy and impact officer, Arron Wood, said political certainty would continue to help drive the “eye-watering” levels of private sector investmentneeded for the government to meet its target of 82% renewable energy by 2030.

“The target is ambitious, but it’s achievable,” Wood said. “With the election behind us, inflation easing and strong industry participation in the Capacity Investment Scheme, the early signs suggest we can expect to see private sector investment in both renewable power generation and battery storage projects continue to increase as the year progresses.”

Renewable energy provided 40% of Australia’s total electricity generation in 2024, up from 39.4% in 2023. The CEC report said an additional 6GW from wind and solar farms would be needed annually by 2030 to replace retiring coal generation.

“The Clean Energy Australia report has a lot of really good news in it,” Wood said, adding that it showed investment flowed with the right policy settings and continuity.

“The willingness to build Australia’s energy transition is there. But that’s not something where you can just set and forget.”

New transmission lines were critical to maintaining the pace, along with connecting projects to the grid as quickly and efficiently as possible, Wood said. Working with communities to build support for the transitionand maximise local benefits was also important.

The director of Clean Energy Finance, Tim Buckley, said there was cause for optimism but maintaining the pace of investment and development required much quicker approvals, construction and commissioning.

maintaining the pace of investment and development required much quicker approvals, construction and commissioning.

“We need to get speed and scale way beyond current rates, particularly with extended delays to grid connection,” he said.

“There is great momentum, and more to do,” said Anna Skarbek, the chief executive of Climateworks Centre.

She said the electricity transition was tracking well in terms of replacing fossil fuels with renewable power.

“We know that to achieve a prosperous economy, in a fully decarbonised global economy, when all sectors are net zero – that actually will use a lot more electricity than what we use today,” she said.

Reaching the government’s legislated target of net zero by 2050 would mean at least a doubling in electricity demand as other sectors including transport, mining and industry sought to cut their emissions.

“We know that Australia has the capacity to do that,” Skarbek said. “Australia does have very large-scale potential to use renewable energy in its heavy industry sectors, and that’s a really important contribution to global trade. And also we have world-class solar penetration at what’s considered small scale or distributed energy in households.”

Battery storage capacity overtakes pumped hydro on Australia’s main grid

Bouldercombe big battery. Source: Genex.

Aug 9, 2023 in Renew Economy

BATTERY, CHART OF THE DAY, MULTIMEDIA, STORAGE

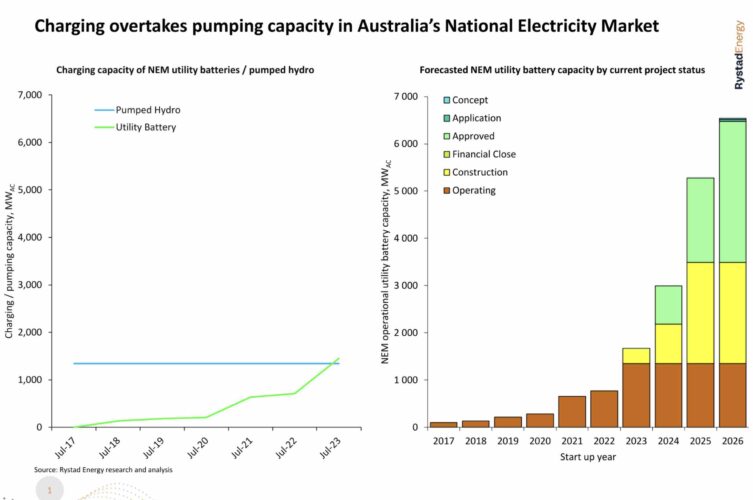

The charging capacity of big batteries in Australia’s main grid has overtaken that of pumped hydro following the connection of two new battery projects – the Capital big battery in the ACT and the Bouldercombe big battery in Queensland.

According to data from Rystad Energy analyst David Dixon, the operational charging capacity of big batteries in the National Electricity Market now stands at 1451 megawatts (MW), compared to 1,340MW for pumped hydro.

Two new big battery projects have just been “energised” – in broad terms connected to the grid – although they are still to work through their full commissioning process, which could take several months.

These new batteries are the 100MW/200MWh Capital battery in the ACT that has been built by French developer Neoen, and the 50MW/100MWh Bouldercombe battery built by Genex Power in Queensland.

Other new battery projects to join the grid in recent months include the 250MW/250MWh Torrens Island big battery and the 41MW/412MWh Tailem Bend battery, both in South Australia, the 150MW/150MWh Hazelwood battery in Victoria, and the Riverina battery complex in NSW.

The gap between battery storage capacity and pumped hydro is illustrated in the above graph from Rystad Energy, which shows the green line (battery), popping up above the blue line (pumped hydro).

That gap will widen in coming years, the table on right illustrates, with up to 6GW of new battery capacity (with varying levels of storage) to be built over the next three years.

Projects already under construction include the 850MW/1680MWh Waratah Super Battery in NSW, the 200MW/400MWh Blyth battery in South Australia, and Neoen’s newly expended 260MW/520MWh Western Downs battery in Queensland.

Origin Energy has also committed to the 460MW/920WMh first stage of the Eraring battery in NSW, and numerous other batteries are about to begin construction after winning key tenders or long term contracts.

Late last week, the Australian government committed to 6GW and 24GWh of new storage through its Capacity Investment Scheme, with much of the new capacity to come from battery storage, although various programs are looking to help pumped hydro projects.

Genex is building the 250MW (eight hour) Kidston pumped hydro project in north Queensland, the first of its type in nearly four decades, while the federal government owned Snowy Hydro is working on the heavily delayed 2000MW (175 hours) Snowy 2.0 project, now not likely to be fully operating before 2030.

The Queensland government is also working on two massive pumped hydro projects in that stage – at the massive 5,000MW Pioneer-Burdekin and the 2,000MW Borumba schemes.

See RenewEconomy’s Big Battery Storage Map of Australia