Norges, world’s largest sovereign wealth fund, de-risks by pivoting investments from fossil fuels to renewables.

Commentary and Report

ESG Is Dead. The $1.6 Trillion Fund Just Proved It.

What Norges Bank’s Latest Report Really Reveals, and Why It Changes Everything

“They aren’t debating the science. They’re selecting the survivors.”

MATT ROSS on LinkedIn and Substack

Why I’m Writing This

I’ve spent years in the shadows of finance and the forests of smallholder systems, building sovereign strategies for the world that was coming—not the one the spreadsheets assumed.

That’s why I created Natural Capital Trader.

Not to theorise, but to decode.

To bridge the world of capital and the land of solutions.

To translate trillion-dollar moves into real, tangible action where it actually matters on the ground, with decentralised producers, indigenous knowledge holders, and regenerative systems that don’t need saving, they just need seeing.

For over a decade, I’ve watched the patterns.

I’ve known that the current model was blind to the tail risks it was birthing.

So I built systems for asymmetric returns, ready for when the tide turned.

That moment has now arrived.

It’s no surprise to me that Norges Bank has moved first again.

The Report A Few Are Reading. But Everyone Should

While markets obsess over inflation ticks and Fed minutes, Norway’s $1.6 trillion sovereign wealth fund, the largest institutional investor on the planet, has just published a report that rewrites the rules of investing.

This isn’t ESG window-dressing.

This is the funeral for ESG and the birth of integrated, planetary finance.

Signal #1: ESG Is Dead. Long Live Integrated Risk.

Forget disclosure checklists and ESG labels.

Norges has replaced them with:

- A proprietary “expectation scoring” system across climate, biodiversity, and water

- AI models that extract raw intelligence directly from corporate filings

- Portfolio-wide geospatial mapping of exposure to nature collapse

This isn’t compliance.

It’s financial hygiene for a new world.

As their Chief Risk Officer states bluntly:

“Climate and nature risks are already impacting the markets we invest in.”

Translation: the repricing has begun.

Signal #2: The Physical Risk Awakening

Here’s where it gets seismic.

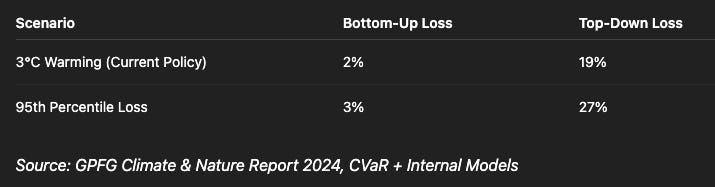

Norges Bank ran two models:

Model Type x Estimated Portfolio Loss

Bottom-up (traditional) 2–4%

Top-down (new internal)19–27% (US equities alone)

That’s a 10x discrepancy.

They’re no longer just modelling “orderly transitions”.

They’re war-gaming 3°C+ warming scenarios and the economic destruction that follows.

Signal #3: The Nature Ultimatum

They’ve gone deeper than any other fund:

- 8% of holdings sit within biodiversity hotspots

- Their largest sector is Tech which actually has high exposure to water stress

- Basic materials, utilities, and industrials face 28% valuation loss in ecosystem collapse scenarios

This isn’t risk assessment.

It’s battlefield intelligence.

They know exactly which factories, mines, and assets sit on the front lines of collapse.

The Visual That Breaks the Illusion

Top-Down vs Bottom-Up Loss Estimates

Conclusion:

The entire financial sector has been grossly underestimating systemic collapse.

Norges just told us.

Watch Their Moves, Not Their Words

Norges isn’t theorising. They’re reallocating:

- Divested: 10 high-risk companies

- Reinstated: 8 who proved transition alignment

- Invested: 1,891MW of new renewable energy capacity

- Merged: Energy Equities + Renewables into a single transition taskforce

They aren’t debating the science. They’re selecting the survivors.

The Asymmetric Opportunity

This is where the story shifts.

While others debate ESG scores, Norges is calculating which geographies, assets, and behaviours will still generate returns in a resource-constrained, climate-volatile world.

They’re executing on something I’ve spent the last decade building for.

And in the next post, I’ll be revealing the single most asymmetric nature investment thesis I’ve ever developed, one that surpasses the wildest wishlist of any VC, yet is anchored in real, sovereign, multi-sector infrastructure.

The Unicorn You’ve Never Heard Of (Yet)

I’ll also introduce you to a company most of the world doesn’t know yet, but they will.

A company that can:

- Forecast the unknown

- Model fat tails where everyone else draws a blank

- Make high-complexity environmental prediction as easy as Spotify, and cheaper than your home or health insurance

This isn’t a dashboard. It’s the risk GPS of the future.

A unicorn in its earliest stages of manifestation operating in the blind spots of Hedge Funds, MSCI, and Moody’s alike.

The Hole in the Market Is Now Obvious

- Traditional models can’t see it

- ESG consultants can’t touch it

But you can now act on it

Final Thought

The repricing of all assets based on environmental reality has already begun.

Not next decade. Not even next year. Now.

The question isn’t whether you believe it.

It’s whether you move before the market does.

Excerpts from Norges Bank Annual Report 2024

Framework and principles for responsible investment management of the Government Pension Fund Global

Responsible investment management of the Government Pension Fund Global

The Executive Board has laid down principles for responsible management in Norges Bank. The principles are based on international principles and guidelines for sound corporate governance and responsible business conduct from the United Nations (UN) and the Organization for Economic Co-operation and Development (OECD).

The objective for the management of the Government Pension Fund Global (GPFG) is to achieve the highest possible return with acceptable risk. Responsible investment supports the objective in two ways. First, by promoting long-term value creation. Second, by reducing the financial risk associated with environmental and social factors in companies. Separate due diligence assessments are conducted, seeking to identify and manage investments with a risk of negative impact on people and the environment.

Norges Bank’s mission is to safeguard and develop financial assets for future generations. The management mandate states that work on responsible investment shall be integrated into the management of the GPFG. Long-term returns depend on sustainable growth, well-functioning and legitimate markets and sound corporate governance. Work on responsible investment can be divided into three main areas: the market, the portfolio and the companies.

The market

Common standards

The GPFG is a global fund which owns a small part of more than 8 500 listed companies in 70 countries. NBIM therefore looks to global solutions to solve common challenges such as climate change. NBIM also contributes to the development of relevant international standards and NBIM’s Chief Governance and Compliance Officer has been appointed chair of the International Sustainability Standards Board (ISSB) Investor Advisory Group (IIAG). In 2024, Norges Bank participated in 30 public consultations related to responsible investment management. All consultation responses are published on NBIM’s website. The consultations include significant issues such as corporate reporting, governance and responsible business conduct.

Selected initiatives where several companies or investors meet to discuss common standards and principles for sustainable business are supported. Such initiatives are particularly appropriate when companies in one industry or value chain face the same challenge. NBIM currently participates in a number of different collaborations with investors, companies and civil society.

NBIM participates in initiatives that are in line with the management mandate for the GPFG and supports the management objective but does not collaborate with other investors on voting or investment decisions, nor does it participate in initiatives that are primarily aimed at political authorities.

Clear expectations

Since 2008, NBIM has formulated clear expectations as to how investee companies should address relevant sustainability challenges in their operations and has emphasised that their boards should establish appropriate strategies, control functions and reporting procedures. The expectations form the basis for dialogue with investee companies and the investee companies’ work is measured against these expectations on an annual basis.

Expectations concerning investee companies’ management of challenges and opportunities related to human rights and consumer interests were updated in 2024. NBIM has also presented its positions on various corporate governance issues in order to enhance corporate governance and protect shareholder interests.

Portfolio

Identifying and managing risk

NBIM’s assessment of corporate governance and sustainability provides a better understanding of risks and opportunities associated with the GPFG’s investments. NBIM monitors how the portfolio is exposed to risks and identifies industries and companies for further follow-up. To carry out these analyses relevant, comparable and reliable data on environmental, social and governance (ESG) issues is important.

NBIM uses five main approaches to identify and manage risks associated with ESG issues in the portfolio:

1. Quarterly pre-screening of companies entering the GPFG’s equity benchmark index

2. Monitoring of companies in the portfolio and the equity benchmark index

3. Daily monitoring of incidents and controversies in the portfolio and the equity benchmark index

4. Thematic assessments of companies with high sustainability risks

5. Quarterly due diligence assessments of companies in the portfolio and the equity benchmark index against our sustainability expectations.

When companies presumed to have heightened ESG risk are identified, further analysis is conducted to assess whether dialogue should be initiated with the company, whether Norges Bank’s voting should be affected or whether Norges Bank should divest from the company due to the risk. Relevant information is also shared with the Council on Ethics, an independent body established by the Ministry of Finance.

Risk-based divestment

To limit the GPFG’s exposure to unacceptable financial risk, NBIM can, within the limits of the mandate, divest from investee companies. This applies principally to companies that impose substantial costs on other companies and society as a whole and that are therefore deemed unsustainable in the long term. Risk-based divestments may be appropriate if it is considered that the investee company poses particularly high long-term financial risk, where investments are not substantial and active ownership is not considered to be a suitable instrument. Unlike ethical exclusion, risk-based divestments are made within the limits of the management mandate and are not contingent upon advice from the Council on Ethics.

In 2024, Norges Bank divested from 49 investee companies following risk assessments related to ESG issues. The Bank has divested from a total of 575 investee companies since 2012. These divestments are investment decisions made by NBIM and are not ethical exclusions decided by Norges Bank’s Executive Board on the basis of recommendations from the Council on Ethics. Since 2012, risk-based divestments have contributed positively to the cumulative return on equity management by 0.64 percentage point, or about 0.02 percentage point annually. In 2024, 16 companies were reincluded in Norges Bank’s investment universe following the reversal of divestment decisions. In total, 25 companies have been reincluded since 2012.

Investment opportunities

Investment opportunities are identified by analysing, among other things, companies’ governance, operations and environmental and social risks and opportunities. In emerging markets, NBIM can also benefit from the knowledge of external managers with an in-depth understanding of the markets, industries and companies in which they invest. This is particularly important as it can often be difficult to obtain relevant company data in emerging markets.

Investment in renewable energy

Up to 2% of the GPFG may also be invested in unlisted renewable energy infrastructure. In 2024, Norges Bank made several joint venture investments in solar and wind power projects in Spain, Portugal and the UK. An agreement was also signed to invest in the Copenhagen Infrastructure Partners fund, CI V, which focuses on offshore and onshore wind, solar power parks, electricity grids and energy storage in North America, Europe and advanced economies in the Asia-Pacific region.

Companies

Dialogue

As a long-term investor, NBIM engages in regular dialogue with the largest investee companies. The dialogue is intended to contribute to good corporate governance and responsible business conduct. The size of the investments provides access to board members, senior executives and specialists in these companies. NBIM is interested in understanding how the companies are governed and how they address essential sustainability issues. In addition to meetings, written contact with the companies is also used. In 2024, a total of 3 313 meetings were held with 1 342 investee companies. ESG-related topics were discussed at 1 986 meetings with 950 companies, accounting for 65% of the value of the equity portfolio.

Reporting

NBIM assesses investee companies’ sustainability-related reporting on their governance structure, strategy, risk management and objectives based on the published expectations of companies and use of third-party data. Investee companies with limited reporting in high-risk sectors are contacted and encouraged to improve their reporting in accordance with the expectation documents, for example by using recognised reporting standards. In 2024, letters were sent to 107 investee companies on their reporting.

Voting

Voting is one of the most important tools Norges Bank has as a shareholder to safeguard the GPFG’s assets. At the end of 2024, the GPFG held a stake in more than 8 500 companies worldwide. NBIM voted on 110 656 matters at 11 154 general meetings in 2024, which corresponds to 97% of the portfolio. NBIM’s voting guidelines are publicly available.

Since 2021, NBIM has published its voting intentions five days before each shareholder meeting with a brief explanation each time the votes go against the board’s recommendations. In 2024, NBIM emphasised transparency further by making public an explanation also when voting in favour of the board’s recommendation, against a shareholder proposal. The GPFG’s voting intentions are available on NBIM’s website. Users can search for individual companies or download the full dataset of NBIM’s votes since 2013 and get daily updates on voting intentions five days before a company’s general meeting. In 2024, NBIM started sharing its voting intentions through the Bloomberg voting platform and communicated more detailed rationales for selected votes for the first time. In 2024, for the second year in a row, NBIM presented a summary of its voting in the first half of the year. The summary provides information about trends and results from voting at the general meetings of investee companies.

The Ministry of Finance has laid down guidelines for observation and exclusion of companies from the GPFG based on their products or conduct. The Council on Ethics and Norges Bank are responsible for following up these guidelines. Decisions concerning the observation and exclusion of companies from the GPFG are made by Norges Bank’s Executive Board, based on recommendations from the Council on Ethics. Norges Bank excludes companies which violate fundamental ethical norms through their conduct or products. Ethical exclusions are not financially motivated decisions. By not investing in such companies, the GPFG’s exposure to unacceptable risk is reduced. All advice from the Council on Ethics to Norges Bank is made public once the Executive Board has made a decision. In 2024, Norges Bank announced the exclusion of 14 companies, revoked the exclusion of seven companies, closed the observation of six companies and extended the observation period for one company. The Bank ended its active ownership under the guidelines in two cases and initiated active ownership in one case. Since 2006, the equity benchmark index has returned 0.98 percentage point less than it would have done without any ethical exclusions. On an annualised basis, the return has been 0.01 percentage point lower.

Further information on responsible investment is provided in the reportResponsible investment Government Pension Fund Global 2024.

Work on climate risk in the Government Pension Fund Global

Climate risk management is an integral part of the responsible investment management of the Government Pension Fund Global (GPFG). The 2025 Climate action plan describes Norges Bank’s work on managing climate risk and the measures scheduled for implementation between 2022 and 2025. The purpose of the measures is to improve market standards, including frameworks for climate reporting, and increase the Fund’s resilience to climate risk. The measures are part of NBIMs targeted and active ownership.

Credible company goals and plans

At the heart of NBIM’s active ownership is driving investee companies to net zero emissions by 2050 through setting of credible goals and plans to reduce their direct and indirect greenhouse gas emissions (scopes 1, 2 and 3). By the end of 2024, 32% of the investee companies had set 2050 net zero targets based on recognised standards such as the Science Based Targets initiative (SBTi) or similar initiatives. If weighted according to emissions, such targets cover about 74% of the fund’s investee companies’ financed emissions (scopes 1 and 2). Weighted by their value in the portfolio, these companies amounted to 69% in 2024.

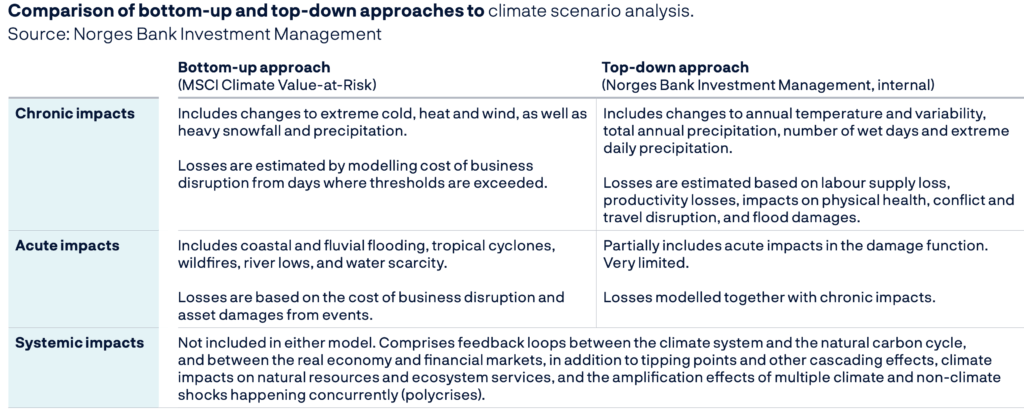

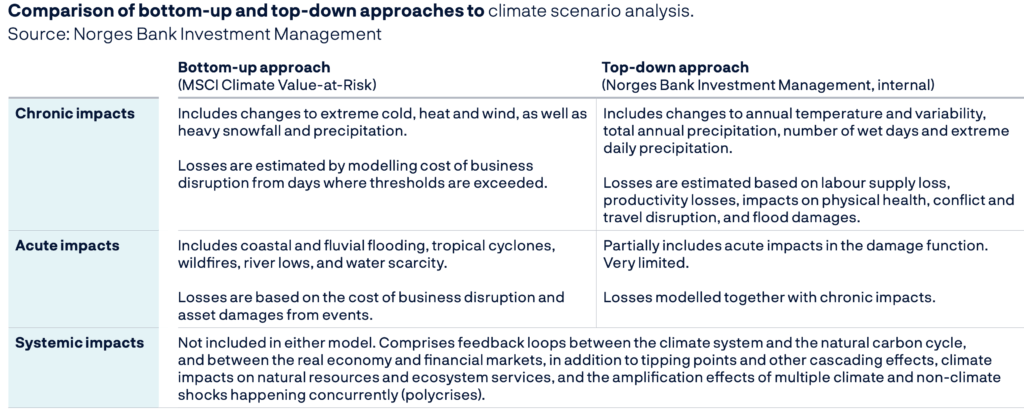

Reporting on climate risk

The 2025 Climate action plan also aims for more reporting on climate risk in the portfolio. The reporting will be developed in line with leading international standards and is included in NBIM’s overall reporting on responsible investment management. Among other things, a separate overview of climate risk is presented, which follows the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Analyses and stress tests against various climate scenarios are presented, including a scenario consistent with global warming of 1.5 degrees Celsius. The methods for such analyses are still evolving and do not provide a basis for ranking direct financial outcomes of various climate scenarios. The modelling of long-term economic effects of climate change resulting from a high increase in temperatures is particularly underdeveloped. The models are therefore likely to provide too low estimates for economic effects. The stress tests nevertheless illustrate the potential effects of climate change on future risks and returns.

The GPFG’s climate and nature reporting also covers exposure to nature and changes in nature and the resulting economic consequences. The reporting follows up on the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD), showing the measures we implement and the tools we have to handle related risks and opportunities.

Indicators for measuring climate risk

In accordance with the Greenhouse Gas (GHG) Protocol, emission measurements are divided into three scopes, depending on how closely related they are to the process or activity:

Scope 1 comprises all direct GHG emissions

Scope 2 comprises all indirect GHG emissions from purchased electricity

Scope 3 comprises other indirect emissions

Emissions intensity

Emissions intensity is an indicator for calculating the GHG emission intensity of a process, activity, service rendered or a portfolio of financial assets. Emissions intensity is used by asset managers to express the carbon footprint of investment portfolios, as recommended by the Task Force on Climate-related Financial Disclosures (TCFD). In manufacturing, emissions intensity is expressed in CO2 equivalent per unit of output (kg, litre, kwh). In equity management, emissions intensity is used to understand the volume of emissions related to earnings of investee companies. Norges Bank reports annually on the emissions intensity of the GPFG’s equity and corporate bond portfolio and the equity portfolio of the foreign exchange reserves, for scopes 1 and 2. Emissions intensity is calculated as emissions of tonnes of CO2 equivalent per USD million of revenue.

Financed GHG emissions

Financed GHG emissions are an alternative indicator originating from the Partnership for Carbon Accounting Financials (PCAF) and their guidelines on how financial institutions should report carbon emissions across asset classes. Norges Bank Investment Management became a formal member of PCAF in 2023. Financed emissions are calculated by multiplying a company’s total emissions by the investor’s financed share of the company’s value, including both equity capital and debt. Norges Bank reports annually on the financed emissions of the GPFG’s equity and corporate bond portfolio and the equity portfolio of the foreign exchange reserves, for scopes 1, 2 and 3.

Measuring carbon footprint

Norges Bank has measured and published the carbon footprint of investee companies in the equity portfolio and benchmark index since 2014, based on reported and modelled data for scope 1, 2 and 3 emissions. In 2024, the Bank has improved the measuring of financed scope 3 emissions to include companies’ upstream activities. There are still many companies that do not report their emission data or whose reporting still varies in frequency and quality. This is in particular the case for scope 3 emissions. This is why Norges Bank exclusively uses modelled figures from our data provider in the calculation of scope 3 emissions. Such carbon footprint analyses provide insight into the extent of greenhouse gas emissions of investee companies and into risks and opportunities across sectors.

Norges Bank’s reporting of the GPFG’s financed emissions is in line with guidance from the Partnership for Carbon Accounting Financials (PCAF). The GPFG’s financed emissions for scopes 1 and 2 were 47 million tonnes of CO2 equivalent in 2024, which is 2% lower than the corresponding figure for the benchmark index. The financed emissions for scope 3 are estimated at 403 million tonnes of CO2 equivalent, which is 2% lower than the benchmark index. Due to significant changes from 2023 to 2024 to the method for estimating financed scope 3 emissions, the figures are not directly comparable. This is based on an estimation model that the Bank has reason to believe underestimates actual scope 3 emissions. The Bank has used a single source for reported and estimated emission data, as recommended by the PCAF.

Investee companies in the GPFG’s equity portfolio emitted 83 tonnes of CO2 equivalent per million USD in revenue, based on data reported or estimated in 2024. This is referred to as the equity portfolio’s emissions intensity in 2024, 6% lower than that of the benchmark index, and 20% lower than in 2023. For corporate bonds, the portfolio’s emissions intensity was 89 tonnes of CO2 equivalent per million USD in revenue, which is 23% higher than the emissions intensity of the benchmark index and 28% lower than in 2023.

Government measures will impact climate risk

The Bank’s understanding of the effects of climate change on the global economy and financial markets will develop. At the same time, governments will introduce new regulations, new technological advances will be seen and consumer preferences will change, and companies will adapt their strategies accordingly. These developments will affect the GPFG’s climate risk. Given the GPFG’s mandate and investment strategy, the GPFG’s climate risk will primarily depend on government measures that ensure an orderly and predictable climate transition and on companies achieving their net zero targets.

Work on climate risk in real estate management in the Government Pension Fund Global

NBIM considers climate change in its real estate investments. The real estate portfolio is exposed to both physical climate risk, such as extreme weather and gradually rising sea levels and flooding, and transition risk, such as a statutory reduction of energy consumption or lower demand for buildings with high emissions. A growing number of tenants are setting targets for net zero emissions for their own businesses, and therefore prefer energy efficient buildings powered by renewable energy sources. The 2025 Climate action plan sets a target for net zero emissions by 2050 for the real estate portfolio and a target of reduced operational carbon emissions intensity (scopes 1 and 2) by 40% by 2030. In order to achieve these targets, the Bank will work to reduce emissions linked to the real estate portfolio and integrate climate risk assessments into investment processes. From 2019 to 20231, the emissions intensity of the real estate portfolio fell by 16%.

The Bank measures progress towards the net zero target in the real estate portfolio using emission pathways consistent with global warming of 1.5 degrees Celsius for various real estate markets, developed by the Carbon Risk Real Estate Monitor (CRREM). By the end of 2023, 43% of the real estate portfolio by value was aligned with these CRREM pathways.

Read more about the work on climate risk in the GPFG in the report Responsible investment 2024 and the publication on climate risk on the GPFG’s website.

Work on climate and climate risk issues in Central Banking

Climate change and measures to mitigate climate change have an impact on the Norwegian and global economy and hence also on Norges Bank’s performance of its core tasks. The Executive Board has primary responsibility for the Bank’s strategy work related to climate change and climate risk. Topics related to climate change and the energy transition’s impact on the Norwegian economy are discussed in the Monetary Policy and Financial Stability Committee.

In 2024, the Bank worked actively to strengthen expertise and integrate climate and energy transition into the Bank’s analyses. Norges Bank has ambitions to share new knowledge through its publications and conferences. In autumn 2024, a conference on the economic consequences of climate change and energy transition was held, with attendees from a wide range of specialist areas.

Since 2018, Norges Bank has been a member of the Network for Greening the Financial System (NGFS), a network for central banks and supervisory authorities. The network provides a forum for sharing experiences and best practices, performs analyses and designs methods for managing environmental and climate risk relevant to financial authorities and the financial sector. Norges Bank cooperates with the NGFS, the International Banking Research Network (IBRN) and other international institutions to enhance expertise on the effects of climate-related changes.

Climate and monetary policy

In order to better understand how climate-related changes affect the business sector, Norges Bank conducts annual surveys of enterprises in the Bank’s Regional Network. The surveys show that climate-related factors, especially factors related to the transition to a low-carbon economy, such as changes in customer preference and climate policies, affect most enterprises. The Bank has also initiated several research projects within this area, one of which examines how extreme weather events in Norway impact Norwegian households’ consumption, income and wealth, while another project examines how energy transition may impact the krone exchange rate over time.

To a large extent, climate transition is energy transition. Norges Bank closely monitors developments in energy markets and works to better integrate these markets into its analytical framework.

Through the NGFS, Norges Bank contributes to analyses of how climate-related factors affect the macroeconomy in general and potential monetary policy implications.

Climate risk and financial stability

In 2024, banks’ substantial exposures to customers vulnerable to climate transition were emphasised as a key vulnerability in Norges Bank’s summary of financial stability assessments. Climate risk was also one of reasons why Norges Bank recommended to maintain the systemic risk buffer requirement.

Climate transition affects banks’ risk assessments through various channels. Financial institutions must ensure that they are well equipped to assess and manage climate-related transition risks.

Adequate information about climate risk may reduce banks’ exposure to losses and help secure the financing of necessary transition measures. In 2024, Norges Bank published a number of analyses that attempted to quantify the consequences of climate transition for Norwegian borrowers. The Staff Memo Firms’ transition to lower greenhouse gas emissions and the risk in Norwegian banks shows that banks may experience a moderate and manageable increase in losses should carbon taxes increase markedly. There are, however, major differences between industries, which make sound banking practices even more important. The Staff Memo Home energy conversion can be a net cost for the average household discusses the potential consequences for Norwegian homeowners of stricter energy efficiency requirements for existing homes.

Climate stress tests and climate scenarios are important tools that central banks use to understand the effect of climate change on the financial system. In 2025, the NGFS will publish short-term scenarios to complement their long-term scenarios, which will provide a new tool for understanding the impact of climate transition. Norges Bank plans to further study how physical climate risk and nature disaster risk may impact financial stability.

Responsible investment and climate risk in the foreign exchange reserves

The equity portfolio of the foreign exchange reserves is managed according to the same principles and strategies for responsible investment as the equity investments in GPFG (expectations of investee companies, voting and company dialogue). This means that the GPFG’s climate action plan, including the target that investee companies adjust their operations to ensure compliance with global net zero emissions by 2050, also applies to the equity portfolio of the foreign exchange reserves.

Decisions on risk-based divestment from individual companies implemented for the GPFG’s equity portfolio are also followed up in the equity portfolio of the foreign exchange reserves. In 2024, Norges Bank divested from five new companies in the foreign exchange reserves’ equity portfolio. In addition, a total of 42 companies were excluded from the foreign exchange reserves’ benchmark index and no new companies were put under observation based on ethical guidelines. The observation of one company was ended in 2024.

Norges Bank measures greenhouse gas emissions in connection with the entire equity portfolio of the foreign exchange reserves using two different metrics, financed emissions and emissions intensity. The financed emissions of the equity portfolio for scopes 1 and 2 were 365501 tonnes of CO2 equivalent in 2024. Financed emissions for scope 3 was 3 420 848 tonnes. Emissions intensity for scopes 1 and 2 was 69 tonnes of CO2 equivalent in 2024, 22% lower than in 2023. The reduction is mostly attributable to risk-based divestment from industrial companies and power producers.

A project has been initiated to stress test the value of the foreign exchange reserves against different climate scenarios. So far, the project has primarily consisted of assessing methods and data. The analysis will help improve the understanding of the potential impact of climate change on the Bank’s balance sheet.

Voting

Board accountability

We hold boards accountable to account for overseeing material sustainability risks and may vote against directors if we find material failures in oversight, risk management or disclosure of environmental, social or climate risks. Before doing so we generally seek to engage with the company to better understand their practices.

In 2024, we voted against 96 directors at 25 companies (23 for climate, two for nature) out of 76 companies identified as having inadequate nature or climate risk management.

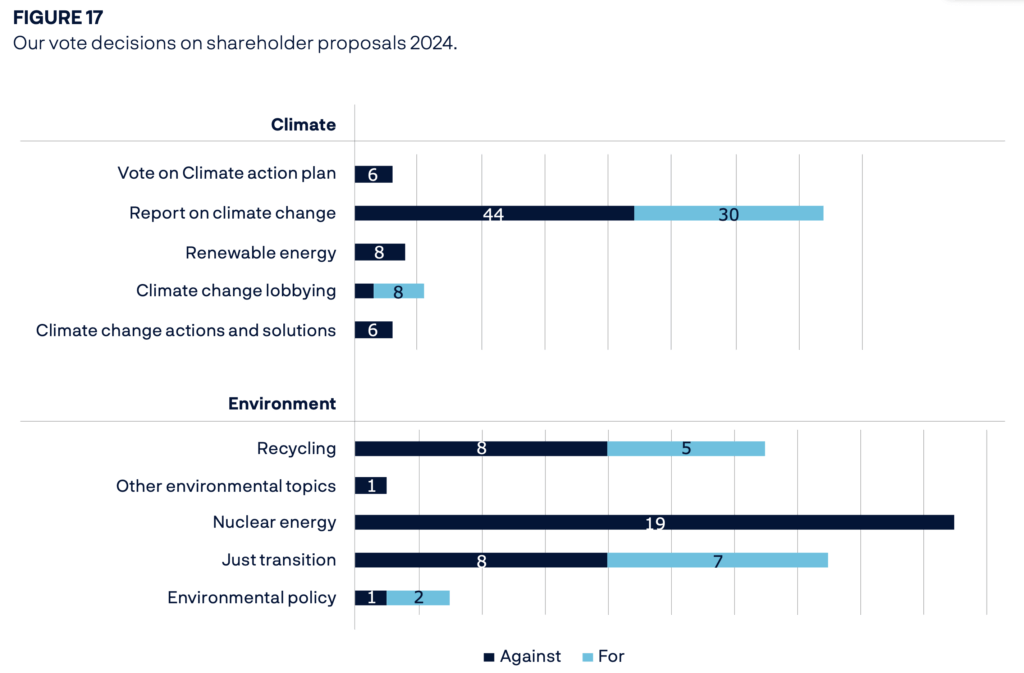

Shareholder proposals

In 2024, we supported 33 percent of 114 climate change proposals and 27 percent of 51 nature proposals. We assess all proposals in detail, and vote according to a framework that considers whether:

• the topic is important enough (i.e. material).

• the topic entails micromanaging the company (i.e. prescriptive).

• the company is already doing enough (i.e. not appropriate).

We opposed many overly prescriptive proposals, such as those demanding articles of association amendments for renewable energy production or annual climate plan votes.

We also filed three climate-related shareholder proposals in the US.

We withdrew two after constructive dialogue with the companies. We proceeded with the shareholder proposal at Kinder Morgan Inc. The proposal received approximately 31 percent support from the investor base. Members of the company’s management and board, who have a significant holding of 12.6 percent, did not recommend support for the proposal. In a meeting with management following the annual meeting, the company committed to paying attention to climate-related risks.