NOT so hard to abate: iron and steel and cement

Hard-to-abate: a justification for delay?

The potential for reducing emissions from the iron and steel and cement sectors

September 2025

AUTHORS: Bill Hare, Hannah Grant, James Bowen

REVIEWERS: Michiel Shaeffer, Neil Grant

CONTRIBUTORS: Cindy Baxter, Victor Maxwell, Nandini Das

EDITING: Cindy Baxter

ABOUT CLIMATE ANALYTICS

Climate Analytics is a global climate science and policy institute. Our mission is to deliver cutting-edge science, analysis and support to accelerate climate action and keep warming below 1.5°C.

There is no single pathway to decarbonising cement and steel, but the continued framing of these sectors as inherently “hard to abate” is both scientifically inaccurate and politically counterproductive.

The evidence is clear: many of the most impactful abatement measures are available today, and their deployment is limited primarily by policy, investment, and institutional inertia.

This is a great new report on what the phrase “hard to abate” has done to corporate climate ambition for heavy industry. Primarily, it has served as a too-hard-to-abate basket, and allowed some companies and industries to palm action off into a distant future.

Executive summary

‘Hard-to-abate’ is an ill-defined but widely applied term. Industry members — and their government supporters — often describe their sector as hard-to-abate to argue against having to reduce emissions quickly, or to justify continued faith in carbon capture utilisation/storage (CCUS) breakthroughs, or using offsets to meet climate goals.

Sectors described as hard-to-abate include cement, iron and steel, fertilisers, petrochemicals, aviation, and shipping. These collectively generate about 21-25% of global greenhouse gas (GHG) emissions.

Achieving global net zero CO2 emissions by around mid-century is critical to the Paris Agreement’s goal of limiting the global temperature rise to 1.5°C above pre-industrial levels and bringing total GHG emissions to net zero in the second half of the century.

Continuing to classify highly emitting sectors as hard-to-abate – and failure to make use of emissions reduction potentials – jeopardises this.

The iron and steel and cement sectors provide valuable case studies of how the ‘hard- to-abate’ label has shaped both policy and industrial actions, in ways that risk undermining the urgency and effectiveness of global climate mitigation efforts.

While the technical and process-related challenges in these sectors are non-trivial, the evidence presented in this report demonstrates that their decarbonisation is not only possible but highly achievable with existing and emerging technologies — especially when guided by integrated, whole-of-system approaches and supported by robust policy frameworks.

We find that while there is no single pathway to decarbonising the iron and steel and cement sectors, the continued framing of these sectors as inherently hard to abate is both scientifically inaccurate and politically counterproductive. The evidence is clear: many of the most impactful abatement measures are available today, and their deployment is limited primarily by policy, investment, and institutional inertia.

Reframing the real challenge

Achieving net zero GHG emissions globally requires considering how fast real emissions can be reduced to as close to zero as possible across all sectors, once all feasible abatement options have been deployed.

Residual GHG emissions will require negative CO2 emissions through carbon dioxide removal (CDR) to counteract their warming effect. This will be critical to bringing global greenhouse gas emissions to net zero in the second half of this century, as required under the Paris Agreement.

Residual emissions in any sector must be very low, if not eliminated, to keep within the limits of what is possible with global CDR deployment. In other words, negative CO2 emissions through CDR – which is subject to serious limitations – should only be used to counterbalance truly unavoidable residual GHG emissions, mainly those from non- fossil fuel sources, to achieve net zero GHG emissions globally.

Not all sectors can reduce emissions at the same rate. This leads to two key policy questions: “how quickly can all available abatement options be achieved?” and “what level of residual CO2 and/or GHG emissions are truly unavoidable by 2050?”

In this context, this report critically examines the hard-to-abate claims of the two key sectors of iron and steel, and cement, which collectively account for about 15% of global CO2 emissions. We illustrate how the hard-to-abate label has often served to lower expectations, delays viable emission reductions and weakens incentives for long- term transformation. To date, the perceived economic and/or political indispensability of iron and steel, and cement has decreased the pressure they face to decarbonise.

Industry members often use the hard-to-abate label to justify overreliance on offsets and CCUS technologies to counterbalance or abate purportedly unavoidable emissions.

As this study shows, there are substantial opportunities to reduce emissions relatively quickly in both the iron and steel, and cement sectors, minimising the need for CCUS and, over time, resulting in low residual emissions.

Zero-emissions steel technologies are already commercially available but need strong policy support to scale-up. For the cement sector, studies with more focus on high deployment of production-side measures still show that incremental changes could enable significant emission reductions at source, for example, a 55% reduction in total emissions without CCUS, compared to 46% in the IEA NZE scenario, by 2050. Yet many studies underplay the added potential of demand-side actions like material efficiency and circularity in reducing residual emissions.

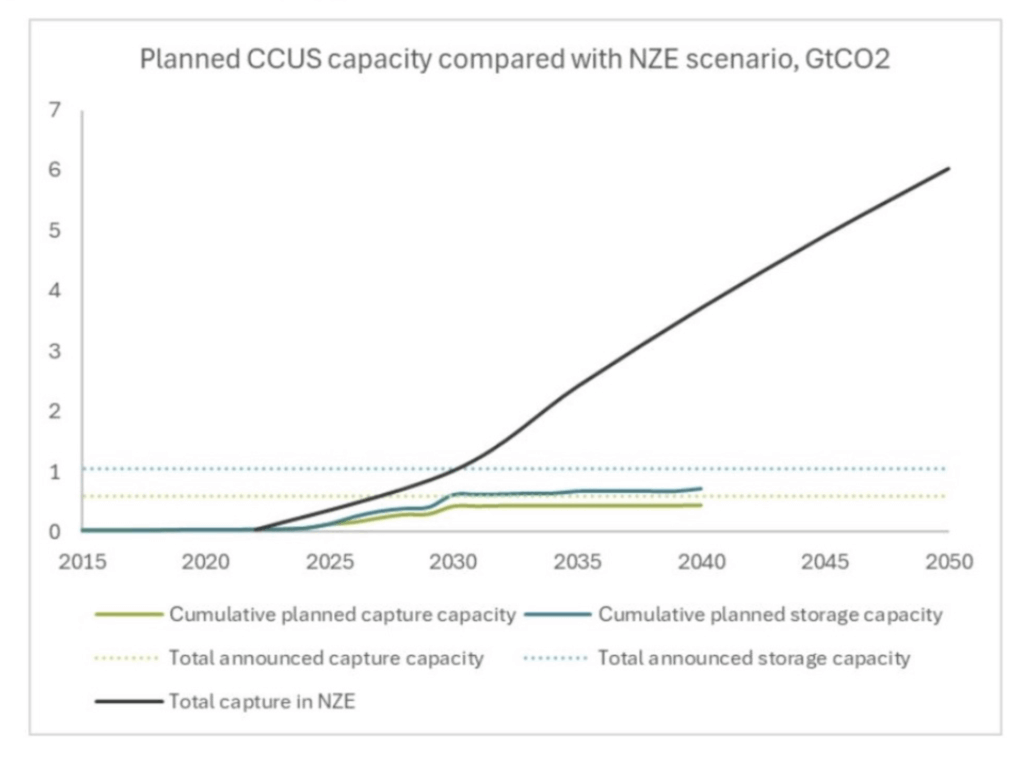

Reliance on CCUS poses substantial technical, economic and scalability risks. It cannot capture 100% of emissions; residual emissions are inevitable. The IEA’s latest NZE scenario, for example, downgraded its estimates for captured CO2 by 39% for 2030 and 22% for 2050 compared to the first NZE scenario released in 2021.

It is also becoming increasingly clear that humanity will need substantial CDR capacity to respond to likely feedback from warming, whereby the Earth system is expected to absorb an ever-smaller fraction of emitted CO2 over time. The limited and uncertain availability of CDR means it should not be counted on to counter-balance residual fossil fuel emissions that could otherwise have been eliminated.

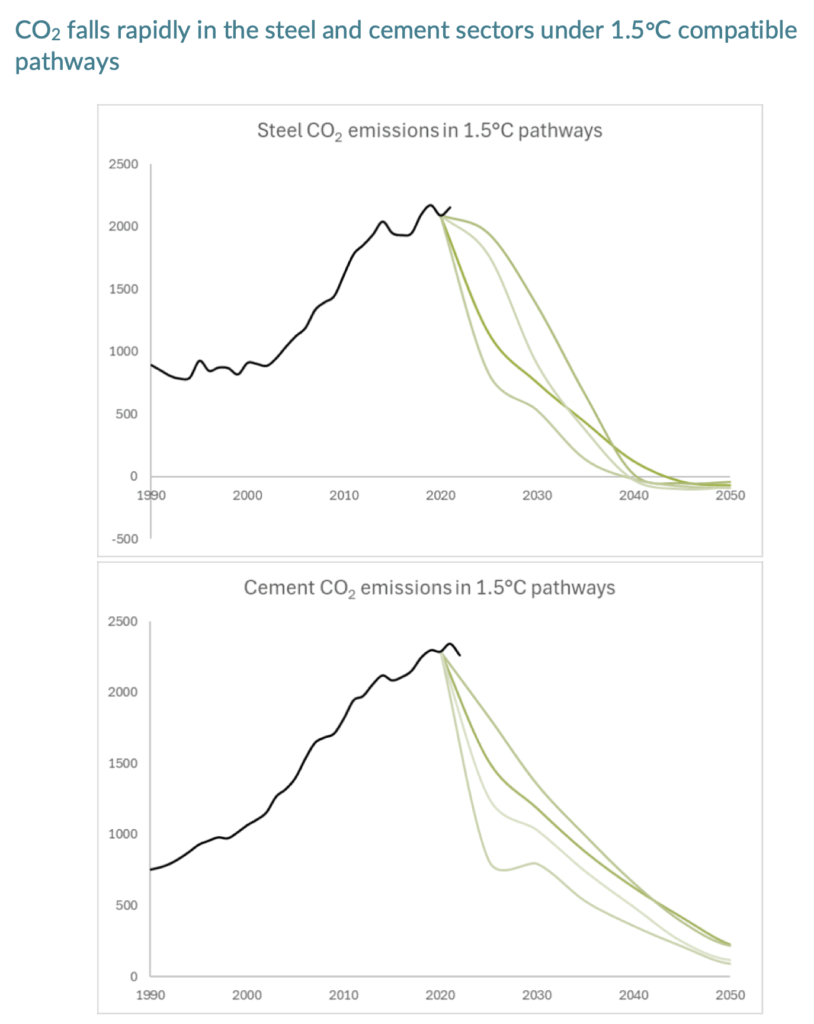

Based on current policies, iron and steel emissions will be just 10% lower, and cement emissions 4% higher, in 2050. In top-down scenarios that limit warming to 1.5°C, such as the IEA’s NZE roadmap, combined CO2 emissions for iron and steel and cement fall by about 23% by 2030 below 2023 levels, 46% by 2035 and 94% by 2050.

The IEA NZE relies on significant CCUS, particularly for cement, to address process emissions. By contrast, bottom-up studies show faster emissions reduction is possible through enhanced focus on demand-side measures such as material substitution and efficiency for each sector, with a much-reduced need for CCUS.

A whole-of-system approach could deliver deeper cuts and reduce reliance on CCUS.

Close inspection of production pathways, and the broader economic and political landscape surrounding each sector reveals framing these sectors as hard-to-abate has lowered ambition and encouraged unnecessary dependence on CCUS, delaying the deeper transformations needed to reach net zero.

Iron and steel

The iron and steel sector accounts for 7-8% of global greenhouse gas emissions.

Technologies for achieving zero emissions in steel production are currently available at commercial scale, but strong policy support is needed. The claim that iron and steel production is hard-to-abate is therefore misleading. It mainly rests on the incumbency advantages of a particularly fossil fuel-intensive production route, for which there are technologically viable substitutes.

The iron and steel industry is dominated by the carbon-intensive blast furnace-basic oxygen furnace (BF-BOF) production method, which accounts for about 72% of production. Yet there are proven alternatives such as electric arc furnaces (EAF), which can help significantly increase the ratio of recycled to new steel production, while progressively deploying renewable power. EAFs can also produce new steel with direct reduced iron (DRI) made with zero emission inputs, such as green hydrogen.

The iron and steel sector could feasibly reach near zero residual CO2 emissions by around 2050 based on currently available technologies and, if complemented by strong demand side interventions without large-scale CCUS, could potentially eliminate the need for negative CO2 emissions for this sector. Demand reduction measures, such as increased use of secondary steel and improving material efficiency, could reduce steel requirements by up to 20% by 2050, making deep decarbonisation even more achievable. Substantial emissions reductions could be achieved through circular economy strategies that reduce steel demand, such as cutting the ‘overspecification’ of steel in construction, which could lower steel use by 35–45%.

Adopting a whole-of-system approach, including key measures such as extensive scrap steel recycling and materials efficiency, will make this easier to achieve. Achieving near zero steel will require substantial additional policy support, including ‘carrots’ such as investment in low emissions production, and ‘sticks’ of regulatory restrictions on high emissions production.

Decarbonising iron and steel is likely to take longer than for sectors such as power generation. However, bottom-up studies show the potential for relatively rapid action if appropriate policies are put in place.

A recent bottom-up study of steel plants globally shows that advanced retrofitting of existing plants could help limit warming to 1.5oC. Substitution of green hydrogen and, where necessary, CCUS, could lead to large reductions of up to 66% of cumulative emissions from this sector between 2020-2050, compared to estimated emissions levels without any interventions.

Cement

The cement sector contributes 5-8% of global CO2 emissions. Concrete produced with cement is the second most widely consumed material after water.

Industry members can use cement’s current economic importance and its largely self- appointed hard-to-abate status to reduce policy ambition, facing little pressure or incentive to upset a successful but emissions-intensive business model. Current sectoral plans lean especially heavily on CCUS, even though there are very few examples of actual deployment.

What is clear from the available literature is that two broad approaches can be taken to decarbonise the cement sector. One approach heavily emphasises reducing emissions through production-side measures. The other takes a whole-of-system approach, which, along with ambitious production-side measures, also extends to expansive demand-side measures, such as lean construction, material substitution, and lifetime extension of buildings.

On the production side, cement’s core climate challenge of needing to reduce process emissions in clinker production is substantial. But numerous options exist for reducing emissions at source, sector-wide. These include enhanced materials efficiency and substitution, such as reducing cement ratios in concrete, clinker ratios in cement, and developing alternative cements with non-clinker binders; improving energy efficiency, electrification, and fuel switching; and improving recycling/circular economy commitments.

Options already exist at the protoype stage for eliminating cement’s energy-related emissions (~40% of total emissions) and more than half of overall sector emissions could be eliminated through a combination of material and energy efficiency, clinker substitution, novel cements, fuel switching, and electrification by 2050.

Available studies suggest that production-centric approaches could enable significant emission reductions over time. The top-down IEA NZE pathway indicates a 24% reduction of CO2 by 2030, 47% by 2035, and 97% by 2050 from 2023 level, with a heavy emphasis on decarbonisation of the energy supply and CCUS for process emissions. This could still leave large demand for CDR to balance residual emissions.

In addition to production-side measures, reducing overall utilisation, particularly by curbing overbuilding, is vital. By reducing unnecessary demand for new construction, the sector can avoid excessive consumption of cement, further reducing emissions associated with cement production.

A whole-of-system approach could, on the other hand, reduce emissions by about 40% by mid 2030s and about 72% by 2050, compared to 2018 levels, without any plant- level dependence on CCUS. The cement sector could be carbon negative by around 2060. A much-reduced level of CCUS would be needed in this approach, compared tothe production-oriented approach. The whole-of-system approach would require more complex policies and larger engagement with stakeholders outside of the cement production sector.

Decarbonising cement requires a wider and more coordinated range of policies over a longer period compared with iron and steel. Accelerated research and development of further breakthroughs is also a priority. Industry attempts to limit attention to their own supply chains will frustrate quick abatement and help sustain considerable 2050 residual emissions.

Image: failure of the promise of carbon capture technology

Avoiding strategies of delay

The iron and steel and cement sectors illustrate how the hard-to-abate label can act, or is even designed to act, to delay climate action, justifying continued reliance on future CCUS and offsets rather than prioritising immediate emissions reduction.

While transformative abatement options exist, they require significant scaling up from the business-as-usual operations, which is resisted by industry actors who claim emissions are unavoidable.

Despite frequent promotion, CCUS deployment in supposed hard-to-abate sectors — or indeed any sector — remains minimal for abatement purposes. Industry recourse to future CCUS deployment and offsets must also be put in context of doubts about the legitimate mitigation potential of these pathways. CCUS deployment in the iron and steel and cement sectors, despite much talk, has barely occurred. CCUS has also consistently failed to meet its promised potential in a more general sense.