To break its coal habit, China should look to California’s progress on batteries

China has been heavily promoting the use of “flexible” coal-fired power to back up its growing variable power sources and meet peak demand. As batteries redefine how power systems handle peak demand in the United States, a central question for the global clean energy transition is whether China can follow a similar path, write [registration required] Christine Shearer and Ye Huang from Global Energy Monitor in Climate Home News. (from Bob Burton Coal Watch)

Jan 15, 2026

Comment, Energy in Climate Home News

Big strides on battery storage are helping the state and other parts of the US cut their reliance on “peakers” – fossil fuel power plants that crank up at times of high demand

Christine Shearer

Ye Huang

Ye Huang is a senior researcher at Global Energy Monitor (GEM), where she tracks and analyses global renewable energy developments. Christine Shearer is project manager of GEM’s Global Coal Plant Tracker.

As batteries redefine how power systems handle peak demand in the United States, a central question for the global clean energy transition is whether China can follow a similar path and move beyond coal-based backup power.

Batteries now regularly provide roughly one-quarter of California’s peak demand during high-load periods following rapid growth in the US in recent years. In contrast, power generation from natural gas-fired plants fell by 17% year-on-year during the spring and summer of 2025.

Highlighting the strides made in the country’s most populous state, the battery fleet of the California Independent System Operator (CAISO), the state power system, set a new record on August 6, 2025 – discharging 11.2 gigawatts (GW) during the evening peak.

California’s experience mirrors a wider national shift. US battery storage has grown at an annual rate of more than 60% for the past five years, increasing its share of the power mix and reducing dependence on fossil fuel-powered “peakers” – plants which operate for brief periods to avert outages at times of high demand.

Clean alternative to polluting peakers

The US had 999 peaker units in 2021, most fuelled by natural gas. Peakers typically run fewer than 100 to 400 hours per year, usually for short intervals of less than four hours.

As well as being costly to operate due to low efficiency, frequent cycling and rising maintenance costs, the peaker units also emit disproportionately high levels of air pollutants. The Clean Energy Group has found that more than 4.4 million Americans live within one mile (1.6 km) of a peaker plant, largely low-income and historically disadvantaged urban neighborhoods, exposing them to worse air pollution and increased health risks.

But with about 150 GW of peak capacity expected to retire in the US over the next 15 years, battery storage is emerging as a viable alternative.

Compared to the peakers, batteries offer a faster response, greater efficiency and significant environmental benefits. Technological advances are expanding the range of services batteries can provide, making medium-duration storage (less than 12 hours) an increasingly viable option to meet the integration needs of high-renewable systems.

Trump leaves battery incentives alone

Federal policy has laid the foundation for the transition to battery storage in California and elsewhere.

FERC Order 841 allows energy storage to participate directly in wholesale electricity markets, enabling batteries to compete with conventional generators for energy and grid services, as well as receive capacity payments in the same way as fossil peakers.

The Inflation Reduction Act of 2022 further accelerated deployment by extending the Investment Tax Credit to standalone storage, supporting private-sector investment. Unlike incentives for wind and solar, those for battery storage have been largely preserved under the Trumpadministration.

States are increasingly leveraging storage to replace peakers. California, for instance, explicitly targets battery storage to meet reliability and emissions goals, planning to add 15.7 GW of four-hour batteries and 2.8 GW of eight-hour batteries while cutting natural gas use by 70% by 2035.

China’s critical clean energy juncture

China is facing growing flexibility needs due to its recent record-breaking solar and wind capacity additions.

It has been heavily promoting the use of “flexible” coal-fired power to back up its growing variable power sources and meet peak demand. “Flexible” coal power in China refers to retrofitting coal-fired units so that their minimum output can fall to 35% or lower of rated capacity. At present, nearly half of China’s coal fleet (600 GW) is categorised as dispatchable for flexibility needs.

Global renewables goal slips off course after Trump, China moves

However, this reliance on coal is problematic. As historically base-load units, coal plants inherently have slower response times and generate significant pollution, making them ill-suited for frequent ramping. Even with generous and guaranteed capacity payments, many of these coal units struggle to operate profitably. Additionally, the “flexible” coal power policy has been used to justify the continued large buildout of coal power in China, which hit a 10-year record for construction in 2024.

China is already the world’s largest market for battery storage, and installations are accelerating rapidly. Battery storage and demand response could together provide nearly 60% of China’s short-term flexibility needs by 2030, according to the International Energy Agency (IEA).

The US shows what is possible when policy, markets and technology align. China needs to take swift, decisive action to shift from “flexible” coal to battery storage. If batteries are to play a central role, strengthening market mechanisms is a key step.

China risks emissions rebound amid policy shifts, experts warn

China is on track to establish provincial electricity spot markets in which battery storage will be formally recognised as a market participant for grid peak regulation services. Additionally, establishing capacity mechanisms, including implementing capacity payments for battery storage, would further incentivise deployment. Increasing utilisation is also essential: recent policy explicitly calls for higher dispatch levels of battery storage and prioritising its use in system regulation.

Encouraging battery storage to replace fossil peaker plants is not only an effective way to accelerate China’s “dual-carbon” goals, but also helps China to consolidate its global leadership in the battery storage industry. China has the resources, the market momentum and the industrial know-how to leapfrog “flexible” coal and make batteries the backbone of its clean and flexible grid. The question is not whether it can, but how quickly it will do so.

The authors are grateful to Xing Zhang for helpful discussions that informed this article.

TAGS:

china, Coal, Energy transition, renewables

Battery storage becomes biggest source of supply in evening peak in one of world’s biggest grids

Giles Parkinson in Renew Economy

Apr 18, 2024

BATTERY CHART OF THE DAY STORAGE

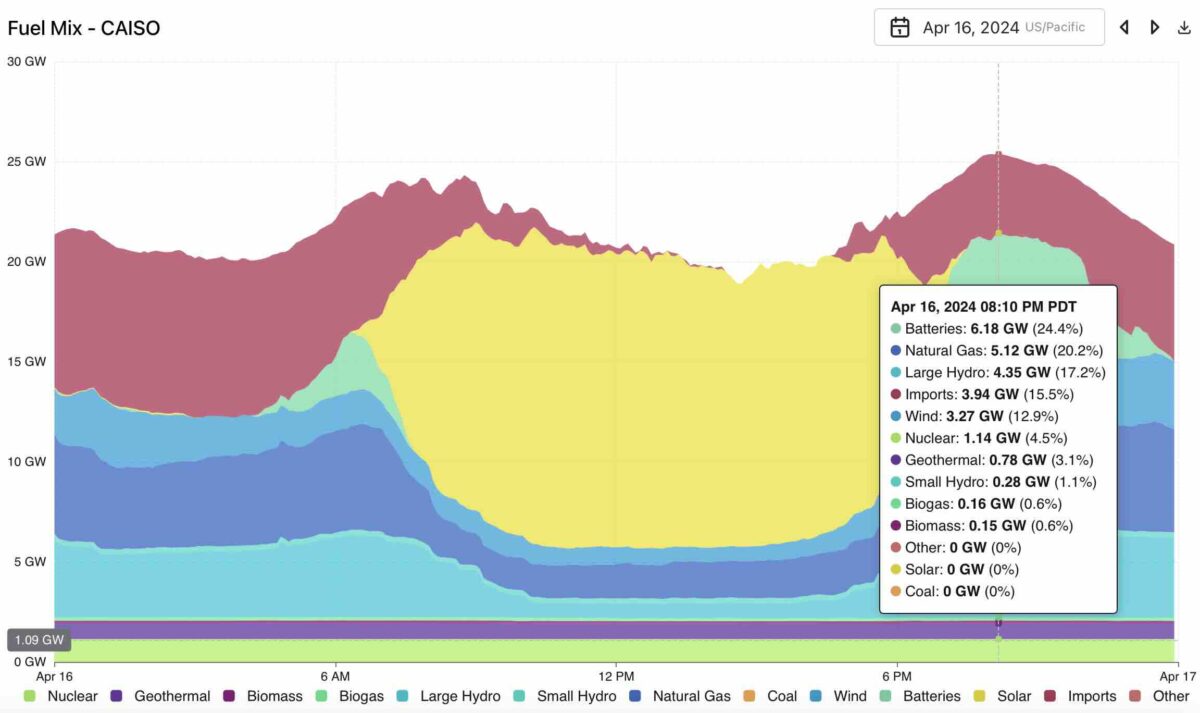

A landmark event occurred in the US on Tuesday night when battery storage become for the first time the largest source of supply in the California grid, which delivers electricity to the world’s fifth biggest economy and is one of the world’s biggest grids.

The milestone was noted by a bunch of energy analysts and data geeks on Twitter/X, including by Joe Deely, who noted that the output of battery storage in the evening peak went above 6 gigawatts (GW) for the first time.

That allowed battery storage to overtake gas, hydro, nuclear and renewables as the biggest source of supply for a period of about two hours in the evening peak.

According to the data tracker Grid Status, the peak output of 6,177 MW from battery storage at 8.10pm local time was nearly 1`0 per cent higher than California’s previous peak of 5,625 MW reached at 7.50pm local time on February 15 this year.

Five years ago, the record output for battery storage was a mere 120 MW, according to Grid Status, highlighting the rapid change in technologies in California’s grid.

The California Energy Commission wrote last October that the state had about 6.6 GW of battery storage installed at the time,most of which was utility scale (5.2 GW). That means that a high percentage of its available capacity was discharging when the record was set this week.

About another 1.9 GW of battery storage capacity is in the process of commissioning, and the CEC estimates that the stage needs about 52 GW of battery storage to meet its 2045 goal of getting all of its power from carbon-free sources. (It does not provide storage duration in those statistics).

“Energy storage systems are a great example of how we can harness emerging technology to help create the equitable, reliable and affordable energy grid of the future,” said CEC Vice Chair Siva Gunda in October last year.

Australia is experiencing a similar transition, although it has some way to go to catch up with the sheer scale of California. Australia, which commissioned what was then the world’s first big battery at Hornsdale in late 2017, now has just over 2 GW (and an average of nearly two hours storage) of battery capacity.

Battery storage plays its biggest role in South Australia, which has a world-leading 75 per cent share of wind and solar in its grid. Battery storage is now a feature of morning and evening peaks, and often accounts for well over 10 per cent of supply, and has peaked in that state at 367 MW. And more big batteries are on their way.

California’s grid has been setting numerous records in other ways in recent weeks, with renewables supplying 100 per cent of its electricity demand for between 15 minutes and six hours in 30 of the last 38 days. Just six days ago it reached a new record for utility scale solar output not 17.786 GW.