Financial Markets Are Already Pricing The Fossil Fuel Phase-Out

By Ingmar Rentzhog,

Contributor. Ingmar Rentzhog is the CEO and founder of We Don’t Have Time.

Dec 14, 2025

A Morgan Stanley survey of institutional investors managing tens of trillions of dollars shows capital is already behaving as if a Fossil Fuel Phase-Out is underway. Not through headlines or pledges, but through mandates, risk models, and capital allocation decisions that quietly reroute money away from assets with declining transition credibility.

COP30’s final text was widely described as weak. The words “fossil fuel” disappeared in the final hours. Financial markets did not wait for better language. They priced the outcome anyway.

In late November 2025, Morgan Stanley’s Institute for Sustainable Investing surveyed more than 950 institutional investors (asset owners and asset managers) across North America, Europe and Asia Pacific. The headline result is simple: more than four out of five expect to increase allocations to sustainable investments over the next two years.

This is not a survey of retail sentiment. The respondent mix includes a large cohort of “mega” institutions. The report notes 201 large asset owners (defined as more than $50 billion in assets) and 73 large asset managers (more than $100 billion in AUM). That implies the survey is capturing decision-makers stewarding tens of trillions of dollars in aggregate, even before counting the rest of the respondents.

PROMOTED

This is how phase-outs happen in practice: not as a single political decision, but as a widening valuation gap.

COP30’s real signal was the coalition for a Fossil Fuel Phase-Out that formed outside consensus

COP30 exposed the limits of unanimity. Yet it also accelerated a parallel track: the willing moving without veto power.

Reuters reported that more than 80 countries backed a roadmap away from fossil fuels at COP30, and that Colombia and the Netherlands agreed to co-host the first international conference next year to carry that work forward. The Guardian similarly reported “more than 80 countries” joining a call for a roadmap to phase out fossil fuels.

This matters for markets because it reduces political ambiguity. When a large coalition begins organizing around a phase-out timeline, investors do not need every major emitter to agree in order to start repricing risk. They need credible direction, momentum, and a pathway that can scale.

The institutional investor pivot is happening despite the “ESG backlash” narrative

Morgan Stanley’s survey is the cleanest counterpunch to the dominant storyline that sustainable investing is retreating.

Key findings from Sustainable Signals, Institutional Investors 2025 include:

- 86% of asset owners expect the proportion of their assets allocated to sustainable funds to increase over the next two years (up from 79% the prior year).

- 79% of asset managers expect a higher proportion of AUM in sustainable funds (slightly up from 78%).

- North American asset owners lead: 90% expect to increase allocations, versus 82% in Europe and 85% in Asia Pacific.

- Investors cite financial performance and a maturing track record as top reasons for increasing allocations.

- Sustainable options are increasingly treated as a mandate differentiator: the survey reports that large majorities of asset owners and asset managers see sustainable investing options as important in selecting and retaining managers.

Top reasons why sustainable investors see asset allocations increasing over the next two years

This is the part many headlines miss: even where politics attacks “ESG,” the investment machinery keeps turning. The survey’s strongest pro-growth signal comes from North America, the very region most often framed as the epicenter of backlash.

The green economy has crossed $5 trillion, and it is being priced like a growth market

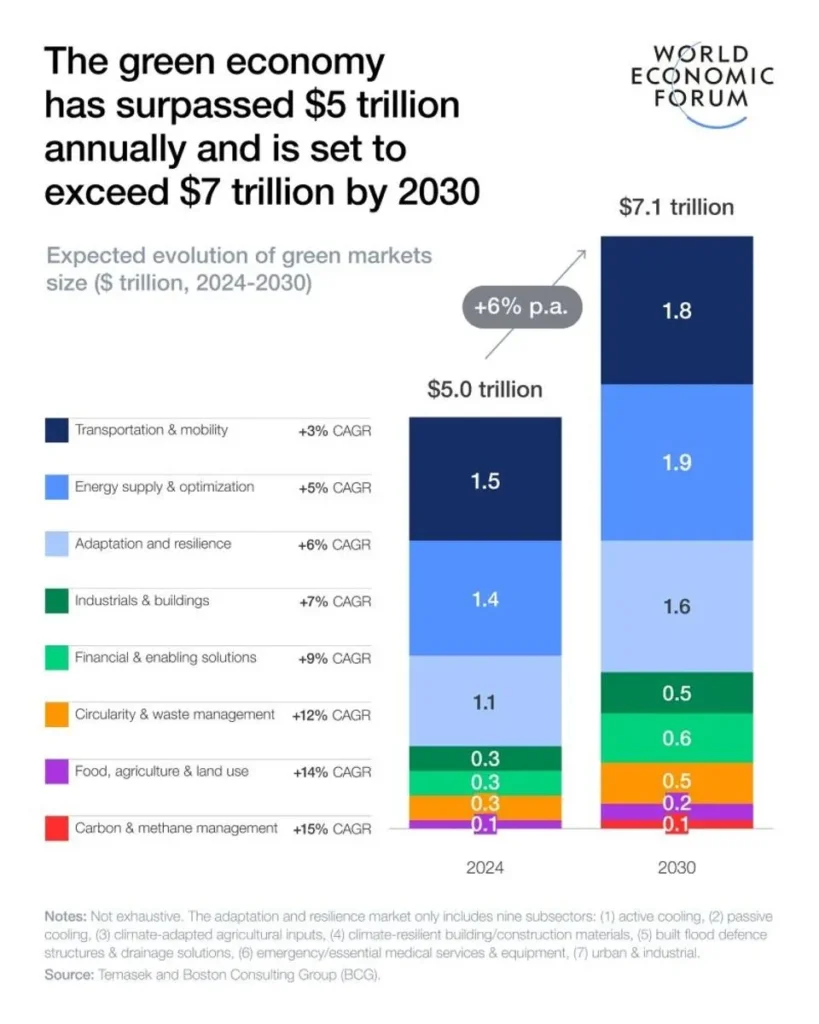

At the same time, the World Economic Forum published a December 2025 synthesis with BCG showing that the “green economy” has already scaled into a multi-trillion-dollar market, with financial characteristics that look increasingly like a mainstream growth category, not a niche.

The report makes a simple point that’s easy to miss in the COP noise: the green economy has already crossed from “future opportunity” into present balance sheet reality. It is no longer a niche. The report describes a market now at roughly $5 trillion annually, with a trajectory of further expansion toward 2030, and with financial characteristics that increasingly resemble a mainstream growth category.

What follows from that scale is even more important. The analysis shows green revenues growing faster than conventional revenues in many sectors, and it highlights a persistent cost-of-capital advantage for companies with green exposure.

That financing edge is where the shift becomes structural. Investors are not simply “adding sustainability” as a label. They are increasingly pricing transition credibility into valuations, treating regulatory durability and physical climate risk as drivers of future cash flows and the discount rates applied to them. Over time, that creates a widening valuation gap. And that is how fossil phase-outs tend to happen in practice: not as a single political decision, but as markets steadily rerouting capital toward the assets that look investable in a decarbonizing world.

Crocodile Economics: why decoupling is the foundation investors are betting on

At COP30, one of the most important finance-adjacent messages was not a pledge. It was proof.

The Exponential Roadmap Initiative’s new report “Crocodile Economics”frames a pattern visible across multiple advanced economies: GDP continues rising while emissions fall. The two curves open apart like a crocodile’s jaws, hence the name.

We call this “crocodile economics” and as we articulate in a new report, it represents a profound shift in the global economy.Johan Falk, CEO & Co-founder Exponential Roadmap Initiative

This matters because it challenges the old assumption that decarbonization is a “cost.” In the crocodile frame, climate progress is increasingly a marker of systems efficiency: better energy productivity, cleaner power, electrification, and technology learning curves that compound.

Post-COP30 Fossil Fuel Phase-Out market behavior: divestment is not theoretical anymore

One of the clearest “after COP30” signals has come from Scandinavia’s institutional capital.

On December 8, 2025, Sweden’s largest pension fund AP7 (which manages default premium pension savings for nearly six million Swedes) expanded exclusions and tightened its framework, adding Aker BP and multiple oil majors such as BP, Chevron, TotalEnergies and Occidental to its exclusion list.

This is what repricing looks like inside an institution: fewer “engagement” stories, more explicit capital rules, more exclusion when transition credibility fails.

Similar dynamics are already visible in fossil-heavy economies where markets have moved faster than politics, including Russia’s coal sector, where collapsing prices, rising losses, and bankruptcies are accelerating a structural unwind rather than a cyclical downturn.

The oil market risk building beneath the surface: more barrels moving, more storage filling, more fragility

Now for the risk that could define the next phase of repricing.

In December 2025, the IEA reported that global observed inventories rose to four-year highs (around 8,030 million barrels in October), with stock builds averaging about 1.2 million barrels per day across the first ten months of the year. Critically, the IEA notes that October’s build was led by higher “oil on water”.

A Wall Street Journal report in December 2025 described a large “oil on water” glut forming at sea, on the order of 1.4 billion barrels, materially above seasonal norms.

This combination is not just a supply story. It is a market structure story.

When storage fills, price behavior can change suddenly:

- In the 2008 to 2009 downturn, weak demand and contango economics incentivized traders to store oil, including in floating storage, amplifying volatility when the market turned.

- In 2020, the world saw how storage constraints can break pricing mechanics when demand collapses and barrels have nowhere to go, contributing to extreme dislocations.

History does not repeat exactly, but the mechanism rhymes: oversupply plus constrained storage equals nonlinear price risk.

And today’s oil market has an additional twist: “storage” is no longer uniquely fossil.

Fossil storage is no longer the only way to store energy

For a century, oil had an advantage: it is energy-dense and easy to stockpile. But electricity systems are changing that assumption.

Battery storage is scaling fast enough to matter at the margin, and margins are where prices break.

- Ember highlights rapid cost declines and improving economics for battery storage.

- BloombergNEF has documented dramatic long-term declines in battery pack prices since 2010, supporting the broader thesis that storage is becoming cheaper and more deployable.

This matters for oil because part of oil’s resilience has been its “buffer” role: a stockpiled energy commodity that can be drawn down when needed. As batteries scale, grids gain a different kind of buffer. That does not replace oil in aviation overnight, but it does reshape the competitive landscape for marginal barrels, and it strengthens the investment case for electrification.

In other words: if fossil markets are becoming a storage problem, clean markets are becoming a storage solution.

A Fossil Fuel Phase-Out reality check: clean energy investment is already larger than fossil investment

The macro allocation backdrop reinforces why institutional investors are leaning in.

The IEA expects total energy investment to reach $3.3 trillion in 2025, with about $2.2 trillion going to clean energy related categories (renewables, grids, storage, nuclear, efficiency, electrification), roughly twice the $1.1 trillion expected for oil, gas and coal.

WRI’s “State of Clean Energy, in 10 Charts” visualizes the same reality: clean investment has outpaced fossil investment for a decade, and the gap is widening.

Conclusion: what to watch next

COP30’s text looked weaker than the world needed. But the system is moving anyway, and the signals are increasingly measurable.

A coalition of more than 80 countries is trying to build a phase-out pathway even when consensus fails. At the same time, institutional capital is behaving as if the phase-out is investable and underway, with a Morgan Stanley survey showing strong intent to increase sustainable allocations, including the strongest signal coming from North America.

The next risk catalyst may come from the fossil side, not the clean side. If oil inventories keep building and “oil on water” starts moving into constrained onshore storage, history suggests price dynamics can shift quickly.

But the deeper shift is structural: oil is no longer competing only with other oil. It is competing with a clean energy system that is scaling both generation and storage, and is increasingly able to absorb variability without burning anything at all.

That is what it means when financial markets start pricing a phase-out, long before politics dares to say the forbidden f-word.

Written by Ingmar Rentzhog, climate communicator and Founder & CEO of Wedonthavetime.org. Follow me on Forbes and LinkedIn for stories at the intersection of climate, finance and the clean-energy revolution.

Editorial StandardsReprints & Permissions

Find Ingmar Rentzhog on LinkedIn and X. Visit Ingmar’s website.

Join The Conversation

Comments

0

One Community. Many Voices. Create a free account to share your thoughts. Read our community guidelines here

.See All Comments (0)

1 of 4 free articles

Become a Forbes Member. Subscribe to trusted journalism that empowers your journey.

© 2025 Forbes Media LLC. All Rights Reserved.