Success: SFV( special financial vehicle) /PPA (power purchase agreement) model. Originally posted as : How major national assets (like Tomago aluminium) can remain viable while de-carbonising

Campaign update: Commitment to secure future of Tomago Aluminium smelter with renewable energy agreement

from Lindsay Soutar Senior Strategist The Sunrise Project

December 2025

What has been announced?

Today (Friday 12 Dec) the Prime Minister, Industry Minister, unions and the management of Tomago Aluminium in the Hunter Valley have announced significant progress on securing the long-term future of Australia’s largest aluminium smelter, using renewable energy. This comes after months of uncertainty for smelter workers- including collapsed bailout negotiations, Tomago beginning workforce consultation on potential closure, and the federal opposition weaponising Tomago in its campaign against ‘net zero’.

Why is Tomago important?

1. Protects thousands of jobs and safeguards an important industrial asset

Tomago supports over 4,000 direct and indirect jobs in the Hunter Valley and is one of Australia’s most significant industrial sites. The announcement today brings us one step closer to protecting these jobs and highlights what we have been saying for a long time – that solar, wind and batteries can repower heavy industry.

2. Unlocks a major clean-energy build-out and strengthens NSW’s grid

Repowering a facility that uses 12% of NSW’s electricity will drive gigawatts of new wind, solar and storage investment. It will also ensure the smelter can continue to provide grid security services, such as load shedding on high demand days and minimum demand on high solar days, as our electricity system is upgraded from ageing coal power stations.

3. Shows “Future Made in Australia” can deliver – and avoids costly bailouts

Tomago is the first major test of whether the government can translate its Future Made in Australia agenda into real outcomes. Securing the smelter with a long-term structural solution – rather than short-term bailouts – shows that Australia can use smart policy design to pair world-class renewable resources with onshore manufacturing, keep high-value jobs here, and cut emissions.

4. Up ends the narrative that clean energy can’t power heavy industry

In recent weeks the Opposition has aggressively claimed that net zero and clean energy is destroying Australian industry, using Tomago as its flagship example. A good deal on Tomago undercuts that narrative. It shows that clean energy can secure major industrial facilities, not shut them down.

5. Creates momentum for a broader clean-industry strategy

Solving the Tomago challenge gives the government a blueprint for supporting other energy-intensive industries to repower with renewables. If the government proceeds with Snowy Hydro underpinning the deal, Snowy will be well positioned to play a bigger role in supplying industry with clean power in the future.

What is the solution being advocated

While the exact design is yet to be confirmed, one option being explored is a a deal that would see Snowy Hydro provide a long term power contract to the smelter – the arrangement a number of union, industry and environmental organisations have been advocating for. Tomago needs long-term low cost renewable power to remain viable, once its current contract with AGL (supplied via Bayswater coal power station) expires in 2028.

While Tomago’s major shareholder Rio Tinto has committed to transition the smelter to 100% renewable energy by 2035, to date they have not been able to secure renewable energy contracts from renewable developers at the price they need.

The proposed solution is for Snowy Hydro to ‘sit between’ Tomago and renewable project developers. Snowy Hydro will write a series of offtake agreements with wind, solar and storage projects (an estimated 3GW of wind and solar and 2GW of storage), and then provide a fixed price contract to the aluminium smelter.

Snowy can offer a better price to the smelter as it has a stronger credit rating, and this can be paired with low interest loans from the Clean Energy Finance Corporation, making the cost of borrowing – and therefore building – for renewable projects cheaper. These cost savings can then be passed on to the smelter in the form of a lower power contract.

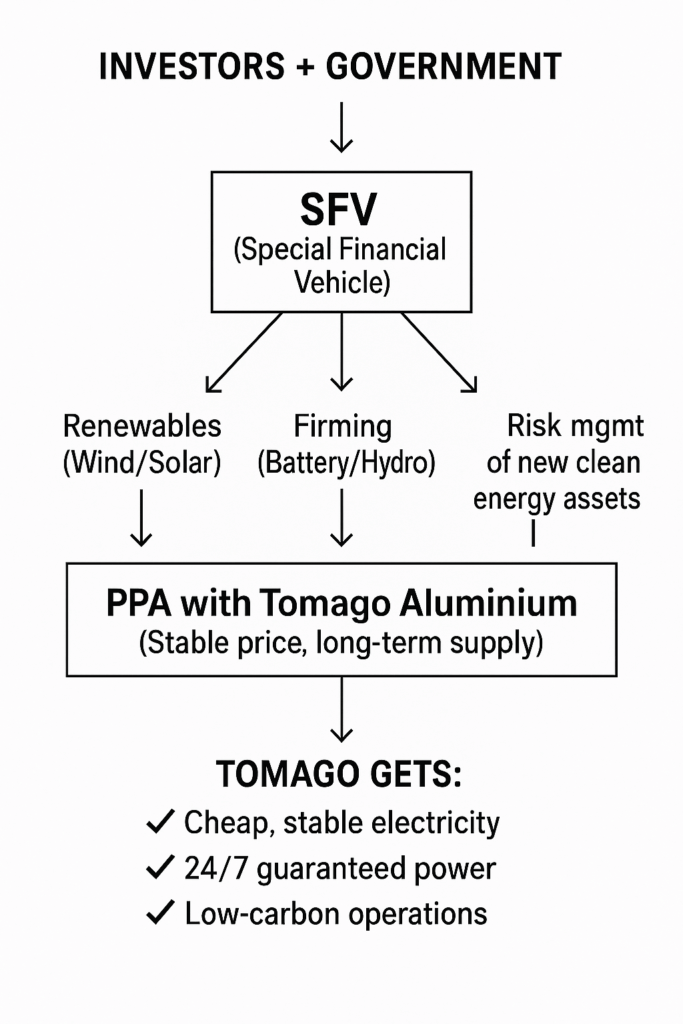

The SFV/PPA model works by using a special financial vehicle to handle money and risk so Tomago can buy clean, reliable power at stable prices—making the business sustainable and giving Australia a proven way to decarbonise other big industries.

🏭⚡ What’s the challenge?

Big factories like Tomago Aluminium need massive amounts of electricity every second.

They also need the price of that electricity to be stable, or else their costs jump around and they can lose money.

At the same time, Australia wants factories like Tomago to use clean energy instead of fossil fuels.

🌞💨 What’s the SFV/PPA model?

Think of the system as a team plan where different players each do a job:

1️⃣ PPA – Power Purchase Agreement

This is a long-term contract where Tomago agrees to buy electricity from new renewable energy projects (wind, solar, etc.).

It’s like agreeing to buy school lunches at a fixed price for 10 years — no surprises.

2️⃣ SFV – Special Financial Vehicle

This is like a big money organiser or a bank account with superpowers.

The SFV:

- collects money from investors and government support

- pays for new renewable energy projects

- pays for “firming” (like batteries or pumped hydro)

- manages risk so Tomago doesn’t have to

- smooths out price spikes in the electricity market

The SFV sits in the middle, balancing everything so the whole plan works.

The SFV is like a trusted treasurer who makes sure everyone gets paid, the money is used wisely, and nobody gets a nasty surprise bill.

3️⃣ Firming

Because wind and solar don’t work all the time, the SFV pays for “firming” resources:

- batteries

- pumped hydro

- gas peakers (short-term backup)

- demand response

This makes renewable power as reliable as coal, but without the pollution.

🧩 How the whole system works together

Step 1: Investors and government put money into the SFV

Step 2: The SFV builds or contracts renewable power + firming

Step 3: Tomago signs PPAs to buy this clean power at stable prices

Step 4: The SFV takes on the financial risk instead of Tomago

Step 5: Tomago gets cheap, clean, reliable electricity 24/7

🏆 Why this keeps Tomago commercially strong

✔ Stable electricity prices

Because the SFV manages risk and the PPAs lock in costs, Tomago avoids big jumps in electricity prices.

✔ Reliable power

Firming ensures Tomago never loses power — extremely important for aluminium smelters.

✔ Big emissions cuts

Most power now comes from renewables, supporting national climate goals.

🇦🇺 Why this helps decarbonise other big industries

Other huge power users (steel, cement, hydrogen, data centres) can copy the same model:

- The SFV collects money and spreads out risk

- PPAs provide stable, cheap clean energy

- Firming guarantees 24/7 reliability

- Industry gets clean power without going broke

It becomes a repeatable national blueprint.

Policy Problem

Australia must decarbonise heavy industry while safeguarding jobs, regional economies and national energy security.

The Tomago model addresses all three policy pillars simultaneously.

How the SFV/PPA Model Solves It

1. Market Creation

The PPA creates guaranteed demand for renewable electricity, enabling large-scale private investment.

2. Efficient Risk Allocation

The SFV:

- Centralises financial risk

- Reduces exposure for industry

- Uses long-term cost smoothing

- Aligns public and private capital

- Mobilises investment that would not occur otherwise

This is a de-risking mechanism, not a subsidy model.

3. Firming and Reliability

Firming assets overseen by the SFV guarantee continuous supply for industries like aluminium smelting that cannot tolerate interruptions.

This ensures energy security during the renewable transition.

4. National Replicability

The model can be immediately adapted for:

- Port Kembla steel

- Gladstone aluminium

- Kwinana refineries

- Emerging hydrogen clusters

- Data centre precincts

It is a scalable blueprint for industrial decarbonisation consistent with Australia’s 2050 net-zero commitments.

5. Economic and Social Benefits

Aligns with international trade requirements such as CBAM (EU carbon border tax)

Protects thousands of regional jobs

Stimulates clean energy investment

Supports grid stability

Maintains Australia’s manufacturing capability